Stop Selling to “India”

On Monday morning, your dashboard tells a familiar story. Customer-acquisition costs are stable, yet the average order value and repeat purchase rates vary widely by pin code. A pilot who sings in two neighbourhoods dies in three others. The slide still says “Target: India,” but the person pinging your WhatsApp support isn’t an average Indian at all.

That buyer is urban and globally exposed. Her income is predictable. Her patience for friction is low. She books appointments, chooses certainty over coupons, and trades up once to stop thinking about the category. In her world, value is measured in time saved, trust earned, and calm delivered.

The Map That Actually Matches the Market (And Where It Comes From)

In “WTF” with Nikhil Kamath—the long-form podcast hosted by Nikhil Kamath, Kishore Biyani lays out a field-tested way to read the country: India-1, India-2, India-3. India-1 is the affluent, urban consuming core. Within it, Biyani draws a practical line between A1—time-poor, certainty-seeking early adopters concentrated in specific neighbourhoods and A2, the broader consuming class that follows once A1 proves utility. India-2 is the rising middle: Tier-II/III families and metro peripheries that upgrade steadily, select premium carefully, and stay value-sharp. India-3 is still solving basics; price comes first, convenience comes later, and trust primarily flows through local networks instead of brands. If you apply this lens even once, your dashboard will stop deceiving you.

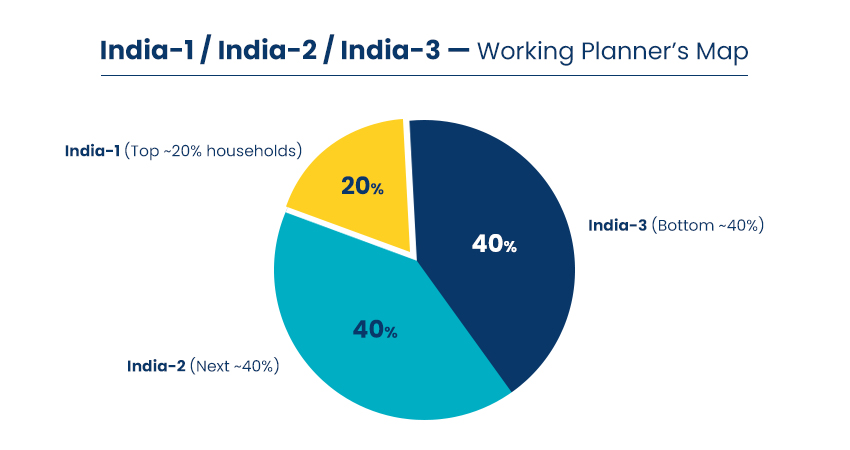

For context on scale, decades of consumer-economy work in India have shown a steep concentration of spending in the top cohort: roughly the top 20% of households behave like India-1 in practice, with the next ~40% forming India-2 and the remainder India-3. The exact percentages vary by source and year, but the behavioural split matters for decision-making.

When the Bills Arrive, the Story Is Boring, In the Best Way.

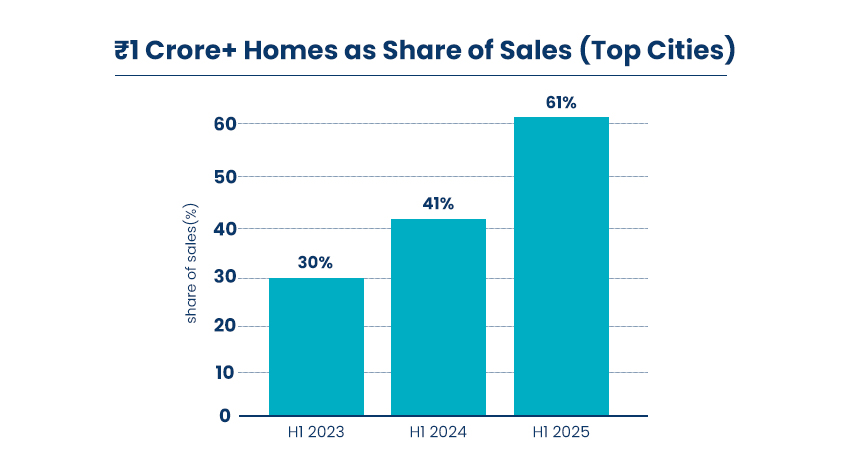

Across the major markets last cycle, ₹1-crore-plus homes took a far larger share of sales than a year earlier: ~41% in H1 2024 across Knight Frank’s tracked cities (up from ~30% in H1 2023). In H1 2025, JLL puts the premium bucket at ~62%. When shelter moves upmarket, the in-home basket moves with it: air and water systems, acoustics, lighting, serious mattresses, built-ins, and, most importantly, installation that starts on time and finishes once.

At the very top, mobility reads like a hedge against uncertainty. Mercedes-Maybach sales in India increased by ~145% in 2024, reaching around 500 cars. By year-end 2024, India’s business-jet fleet reached ~168 aircraft, the largest net addition in Asia-Pacific. That is closer to a service specification than a flex: ultra-rich households pay for time certainty. If your try-on, installation, or repair cannot be completed within a precise window with a named contact who answers, the brand will be replaced; however, the box will remain attractive.

Gold did not disappear; behaviour shifted. In 2024, India’s jewellery demand fell ~2% by volume to ~563.4 tonnes, even as value hit records, because prices were high. Through early 2025, record prices briefly squeezed wedding buying at the margin, while investment rails (coins, bars, ETFs) remained resilient. The underlying pattern is consistent: fewer, finer pieces with airtight documentation, accompanied by a parallel pipe for liquidity.

Weddings remain a rolling balance sheet. Credible estimates place the wedding economy at $130 billion, which makes it the most reliable multi-category shopping calendar in the country. It reliably rewards the operator who makes a chaotic week feel simple.

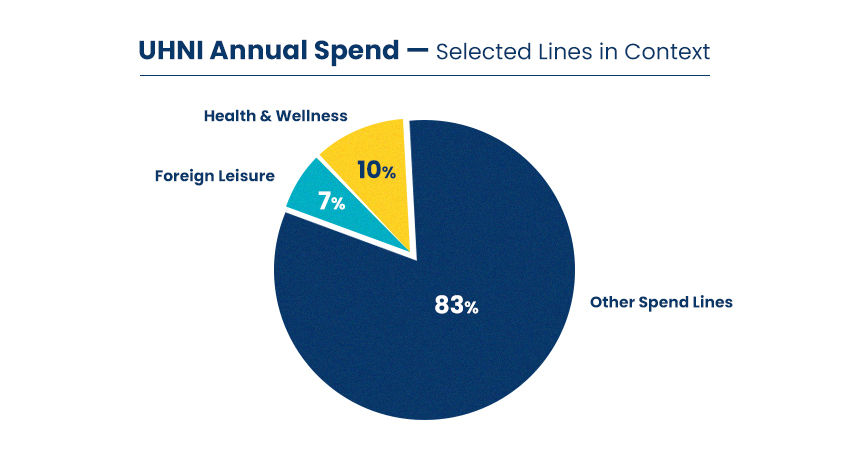

For a consolidated view of how ultra-HNIs allocate their wallets, Kotak Private’s Top of the Pyramid 2024 offers useful insight: they typically park around 32% in equities, spend about 10% on health and wellness, and 7% on foreign leisure. When it comes to property as an investment, the preference leans clearly toward commercial (45%) over residential (33%), yield tends to win over emotion as cheque sizes grow.

Discovery is also localising. Galeries Lafayette opened its ~90,000 sq ft Mumbai flagship in Kala Ghoda with over 250 brands this November, raising the bar for curation and service onshore. “Global curation, local daily use” stops being a wish and becomes a baseline.

And in the background, a dependable outlay repeats. As of January 2024, roughly 1.33 million Indians were studying overseas. That single fact creates a steady loop of housing, health, remittances, technology purchases, and family travel, and it makes a test that many brands fail: a warranty or return that must survive a flight.

The quiet rhythm at the top

Spend a few weeks with a well-run home and you will see how money really moves. On Monday, the family takes possession of a larger flat, and by Thursday, they have booked a water and air upgrade with a brand they trust, fitting it neatly between a school meeting and a late work call. The installation team from that brand arrives at the door at 6:38 pm, within the promised 6:30 to 6:50 pm window. They work carefully, finish the job in one visit, tidy the space, and leave a single phone number that always picks up. No one talks about “premium”, yet the house feels looked after because the promise of time was kept. In homes like these, time is not a feature to be advertised; it is the product that is actually being bought.

The same logic guides every upgrade. For air, water, sleep, light, and storage, the family prefers a single, clear plan from a specialist: a brief measurement visit, a clean installation, and a maintenance schedule that aligns with their calendar rather than the brand’s. The extra price is not for show; it is for finality, because the goal is to decide once and then stop thinking about the category. When a wedding approaches, trust becomes even more visible. A jeweller’s concierge delivers the ring to the venue in a small, calm box that holds the piece, the certificate, the serial number linked to the family, clear insured-delivery instructions, and a simple buy-back line written in plain words. That single card does more for confidence than any advertisement because it lets tradition feel secure while maintaining its value.

A week later, life returns to its steady routine. A child flies back to university, and the family checks luggage, health papers, and adapters in one quiet WhatsApp thread. A small product issue raised from another time zone is collected and fixed without fuss. Brands that can honour a return after a flight and keep service simple earn a kind of loyalty that marketing alone cannot buy. This is how money moves when nobody is posting: time is protected, upgrades are completed, value is recorded, and milestones are handled without noise. The first group inside India-1 pays for this pattern, and the next group follows when they hear a calm, believable story from people they already trust.

What to do next?

First, say the promise clearly and keep it. If your product requires a visit, offer bookable time windows and specify a person who will answer. Explain, in advance, what you will do if you miss the window. In these homes, punctuality is the first visible sign of quality.

Second, bring proof to the surface. Put serial numbers, certificates, insured delivery details, and simple buy-back maths on the product page and inside the box. Do not hide any of it in fine print. Proof is what lets a family trade up without worry and what makes a recommendation easy.

Third, remove the second decision. Provide a clear path from measurement to installation to maintenance, and price it for peace of mind rather than for parts. A family that never has to ask who owns the problem will stay with you.

Finally, treat milestone weeks as operations. For weddings and similar events, create a private channel with the family, keep venue handovers concise, plan for last-minute needs, and close the loop when the event concludes. The prize is not a viral post; the prize is a family that comes back.

Use one simple test to keep the team honest: Could a calm, busy family hand us their next eight weeks, including a home handover, a wedding, and a university trip, without us adding steps? If the answer is yes, you are already selling to India-1. If the answer is not yet, do not add a discount; add certainty. Keep your time windows, make it easy to reach a real person, make documents easy to read, and make returns work even after a flight. These changes do not need a big campaign. They build the brand on their own.