Ever wondered how startups like Flipkart, Zomato, or boAt go from garage ideas to multi-crore giants? The answer lies in a powerful engine that fuels innovation i.e., Venture Capital.

The success stories of these startups brought the concept of ‘Venture Capital‘ and ‘Startup funding’ into the limelight. From news reports to prime-time shows, we’re constantly reminded of the role capital plays in turning ideas into empires. But what lies at the heart of this transformation is more than just money — it’s a strategic belief in potential.

Venture Capital is a specialised form of private equity designed to support both early-stage entrepreneurs and growing businesses looking to scale.

What exactly is Venture Capital?

In simple terms, Venture Capital (VC) is money invested in early-stage businesses with high growth potential. But it’s not just money — it’s mentorship, strategy, and a shot at greatness.

Think of it as a partnership:

● You bring the idea.

● Venture Capitalists bring the resources to scale it.

In return? They earn a stake in your company’s potential success.

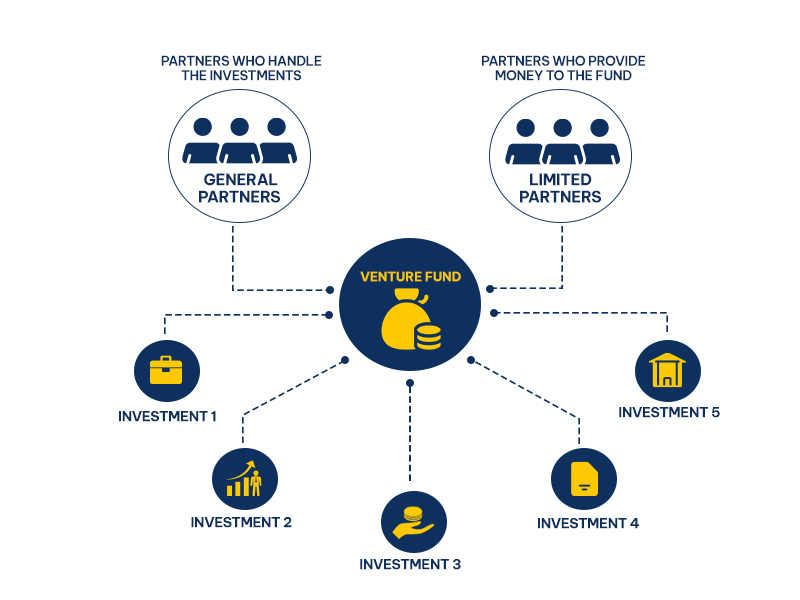

How does a Venture Capital firm operate?

A Venture Capital (VC) firm typically supports several small businesses during their developmental phase, allowing them to cultivate into fully operational ventures together with the capital, thus enabling them to achieve their goals and aspirations.

Some investors focus on specific industries, such as transportation, consumer products, telecommunications, or biotechnology. In return for their financial support, they expect a share of the company’s ownership.

Whether you’re a first-time founder or someone curious about startup finance, this guide breaks down how venture capital works — from its structure to support for India’s fast-growing startup ecosystem.

Key Figures in a Venture Capital (VC) Ecosystem

To grasp the workings of venture capital, it is essential to appreciate the core constituents:

● Founders and Entrepreneurs

They’re the ones with a bold vision and the grit to chase it. But turning ideas into impact takes capital and guidance.

Professional investors who manage pooled funds and bet on promising startups. They evaluate, invest in, and stay actively involved in the growth.

● Limited Partners (LP)

Institutions or high-net-worth individuals who provide the money that VCs invest. Think of them as pension funds, universities, or family offices. They seek to maximise their return but do not participate in everyday decisions related to the investment.

● Accelerators and Incubators

They’re the startup prep schools — helping founders with mentorship, co-working spaces, and early capital before the VC round begins.

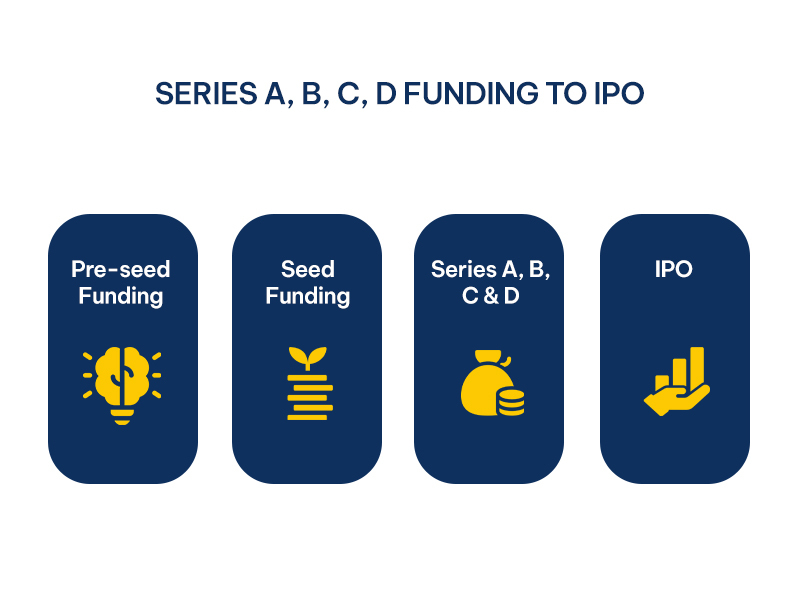

The Venture Capital Funding Lifecycle

Venture Capital investment is not a one-time transaction. It’s structured in rounds of funding, each aligned with the company’s growth stage. Here’s how the typical lifecycle looks:

1. Pre-seed Round

● What it is: An idea or prototype.

● Funding source: Friends, family, or angel investors.

At this nascent stage, the startup may only have an idea or a prototype. Funding comes mostly from personal savings, friends, family, or angel investors.

2. Seed Round

● Goal: Build MVPs, test markets, and hire the early team.

● Investors involved: Seed VCs, angels, and early-stage funds.

Seed Round is the “proof of concept” phase. Startups use this capital to build Minimum Viable Products (MVPs), conduct market research, and hire early team members.

3. Series A

● When? You’ve shown product-market fit.

● Purpose: Scale operations, improve tech and expand teams.

Once a startup gains traction, it can position itself for Series A funding to help scale its product, hire talent, and enter new markets.

4. Series B, C, D

Each round fuels a different growth goal:

● Series B: Optimise operations

● Series C: Go global or diversify

● Series D & beyond: Prepare for IPO or acquisition

5. Exit

The end goal for both Venture Capital firms and founders. This typically happens through:

● Initial Public Offering (IPO)

● Acquisition or Merger

● Secondary Sale (where one investor sells their shares to another)

How Do Venture Capitalists Make Money?

Venture Capital is high-risk, high-reward. Here’s how they earn from their endeavours:

1. Equity Appreciation

When a startup succeeds, and its valuation grows, so does the value of the Venture Capital firm’s equity. At the exit, the VC firm sells its stake at a much higher price than the original investment.

2. Management Fees

Venture Capital firms charge their limited partners (LPs) an annual fee, typically 2% of the total fund size, to manage the fund.

3. Carried Interest

This is the real reward comprising a share of the profits (typically 20%) from successful investments distributed to the venture capital partners.

The Risk and Reward Equation

It is essential to understand that Venture Capital is not for the faint of heart. Studies show that:

● Sixty percent of startups fail to return even the initial capital invested.

● Only one in ten investments becomes a “home run” (such as a unicorn or a successful IPO).

● Despite the odds, those big wins can deliver extraordinary returns that make up for multiple failures.

That’s why VC portfolios are diversified across sectors, stages, and founders to maximise the chance of getting the big payout.

Due Diligence: The VC Selection Process

Venture Capital firms perform extensive due diligence before investing and consider these factors before going forward with an entrepreneur.

● Total Market Opportunity

● Business Model Feasibility

● Competitors in the Market

● Team’s Experience and Future Vision

● Product/Technology Uniqueness

● Growth Indicators (e.g., Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), etc

Tip: The team and market are often more important than just the product.

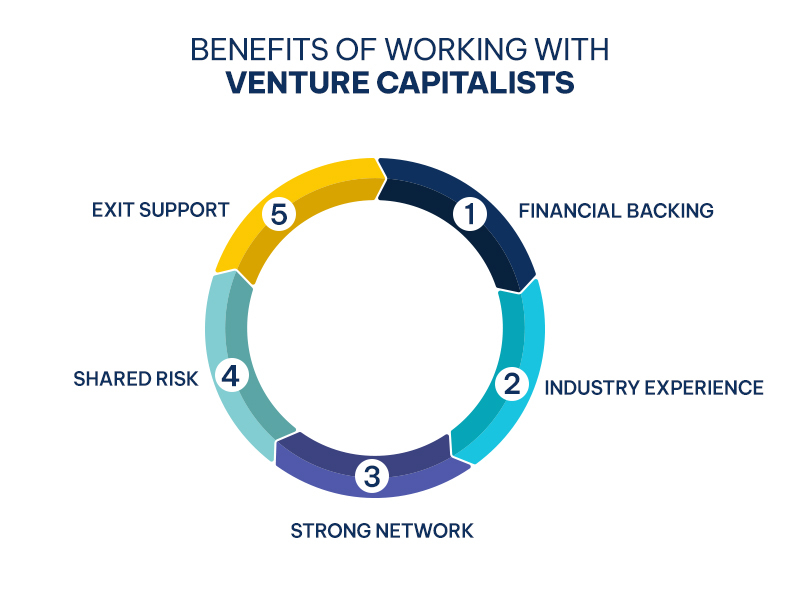

Benefits of Teaming Up with Venture Capitalists

Many people believe that Venture Capital firms bring in capital and nothing else. However, the truth is far from it. Venture capitalists (VCs) provide a multitude of strategic, financial, and operational support to entrepreneurs.

| BENEFIT | WHAT DOES IT MEAN? |

| Strategic Mentorship | Helps in understanding product-market fit and scaling |

| Hiring Support | Access to top talent pipelines |

| Investor Network | Connections for future fundraising |

| Credibility | Association with respected VCs builds trust |

| Governance | Board support, structured decision-making |

FINAL TAKEAWAYS

● Venture Capital = money + mentorship + network.

● Funding comes in rounds (Pre-seed to Exit).

● Venture Capitalists (VCs) generate revenue through equity returns, fees, and carried interest.

● It’s a high-risk game — but one big win can change everything.

● VCs offer much more than money: strategy, hiring help, governance, and brand credibility.

Venture Capital is more than just money—it’s about catalysing innovation, backing bold ideas, and creating future-defining businesses. For founders, it’s an opportunity to scale quickly. For investors, it’s a shot at outsized returns. For the ecosystem, it’s fuel for progress.