The Post-Funding Void: What Really Happens After the Cheque Clears

You just closed your seed round. After months of pitching and refining, the money lands. You breathe. You celebrate. And then, silence.

Emails slow down. Investor calendars go quiet. You’re no longer the centre of attention. This stillness is what many founders feel but rarely mention. It is the post-funding void, where expectations meet emotional fatigue and operational urgency.

Now the real work begins. You’re making heavier decisions like who to hire, how to spend, what to build next. One founder called it “barely surviving.” Burn rate, bottlenecks, and early customer issues take over. The noise doesn’t fade because no one cares. It fades because you’re in it now, building for real.

Why Founders Go Quiet After Raising Funds

Here are some probable reasons why founders go quiet after raising funds:

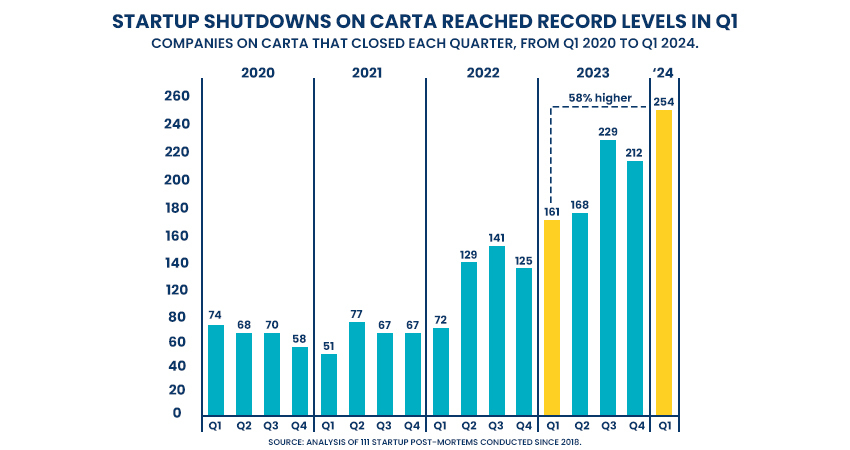

- The pressure starts immediately – The moment the money hits the bank, so does the pressure. From there on, it’s a constant push to prove the money was well-placed. Every decision suddenly carries more weight. The dream has turned into deadlines, targets, and eyes constantly watching. According to Carta’s 2024 Startup Failure Report, venture-backed startup failures rose by 58% in early 2024. Even companies with millions in funding like Tally, Convoy, and Olive shut down when the next round never came. The runway often looks longer than it truly is.

- Doubt starts to feel dangerous – Founders feel uncertain more often than they admit. But they rarely talk about it. Asking for help feels risky, almost like exposing weakness. A report by First Round Capital found that 72% of founders struggle with mental health. But most stay quiet, fearing judgment or loss of confidence from investors. This silence doesn’t just hide the struggle, it slowly erodes clarity, motivation, and decision-making. So they put on a smile, polish their investor updates, and pretend everything is fine.

- From spotlight to firefighting – Yesterday, you were pitching with passion. Today, you’re stuck deep in team issues, product bugs, and demanding customers. The shift is brutal. Operations take over and decision fatigue sets in fast. Communication becomes one of the first things to drop off the to-do list.

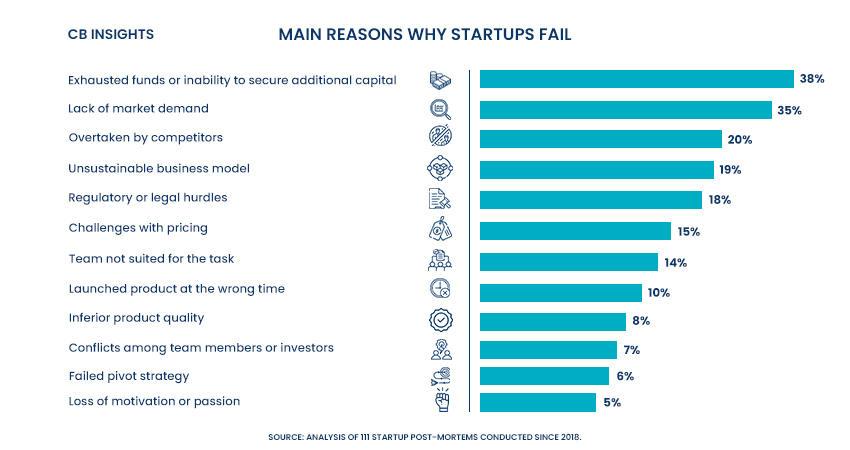

- When the Cash Starts Drying Up – Most founders expect to feel lighter after the raise, but what follows is often the opposite. Pressure builds quietly while energy dips. According to CB Insights, nearly 38% of startups fail because they run out of money. One founder told TechCrunch he didn’t feel anything unless he was just days away from going broke. That kind of disconnect is a clear sign something’s off, even if no one says it.

- Silence feels safer than honesty – When nothing feels obviously wrong, many founders think it’s better to stay quiet. But silence isn’t neutral. Investors often take it as a sign that something’s off. Founders avoid updates to escape scrutiny, but that silence only builds more doubt. Gavin Myers, an early-stage investor, once said that it’s not failure that breaks trust. It’s silence. When communication stops, relationships get cold quickly.

- Waiting for the perfect update – Founders hold off on sharing until they have something impressive to show. A growth win. A big hire. A new product. But while they wait, the updates stop altogether. In the search for polish, progress gets hidden. And investors start feeling left out. The truth is, investors value honesty far more than perfection. Especially in a tough market, staying real matters more than sounding flawless.

The First 18 Months After Funding: What the Data Actually Reveals

Founders often step into a strange silence once the money lands. But behind the scenes, data tells a very different story – one of the rushed decisions, misaligned priorities, and an unforgiving clock.

1. Runway Expectations vs. Reality

Most founders expect a 12–18 month runway post-seed, but reality hits faster than expected. 42% of startups start raising again within just 9 months, mostly because they underestimate burn and overestimate early traction.

2. Headcount Hype Leads to Layoffs

Hiring aggressively right after a funding round can backfire.According to Startup Genome, 74% of high-growth startups fail due to premature scaling, often driven by rushed or aggressive hiring decisions

3. The Metrics That Matter to VCs

Investors are watching more than just revenue.

They care about:

- Day 7 and Day 30 user retention

- Customer Acquisition Cost: Lifetime Value (CAC: LTV) ratio

- How often do you send founder updates

Founders who send monthly updates to investors raise faster and at better terms.

4. Most Startups Don’t Survive to Series A

It’s a tough climb. Only 28% of seed-funded startups successfully raise a Series A within 18 months. The rest either stall out, pivot, or quietly fade away.

What Do Founders Who Make It Through Actually Do?

So, what sets apart the founders who don’t disappear after raising money? The ones who survive the silence and the stress? Here’s what they tend to get right:

They communicate openly, even when it’s not great news

Founders who keep investors in the loop with short, regular updates build trust over time. Just a quick monthly check-in with bullet points: key wins, KPIs, roadblocks, and what’s next. Even if the numbers are flat, that’s okay. You don’t need fireworks every month. Investors just want to know what’s going on. Transparency always beats silence.

They slow down to speed up

Caesar Sengupta, an ex-Google executive who raised $92 million for his startup, once said his daily meditation routine helped him more than any founder playbook. In the middle of chaos, he leaned into calm. That clarity helped him lead with a clearer head and ultimately, better decisions.

They recognise that building is emotional, not just logical

The best founders don’t try to suppress self-doubt, anxiety, or fear of failure. Instead, they learn to sit with it. They know that leadership isn’t just about strategy. It’s also about emotional stamina. Ignoring your inner chaos usually backfires, while facing it helps you think more clearly.

They find their people

It could be a dependable co-founder, a wise mentor, a group of peers who just get it, or even a platform like Reboot or Upekkha. They surround themselves with those who remind them they’re not alone. Talking things through doesn’t offer instant solutions but it makes the burden feel a little lighter. And on the toughest days, that’s often enough to take the next step.

Real Stories from Founders in the Middle

Take It’s Electric, a climate-tech startup that raised $2.2 million in pre-seed in 2023, followed by another $6.5 million in seed funding just months later in 2024. The high of closing those rounds didn’t last long. They had to move fast to build the product, prove it works, and bring in partners. Along the way, they launched EV charger pilots in Brooklyn, teamed up with Hyundai, and made every dollar count. Today, they’re scaling with real traction and momentum.

Other founders on Reddit speak candidly:

“Investor pressure, peer success, social media wins, they blur into this narrative that says you have to keep grinding forever.”

“I love building, but I’m now realising there are parts of me outside of the startup I forgot about.”

It’s not just financial pressure. It’s psychological.

If You’re in the Void Now: A Practical Roadmap

Notice the silence

It might feel like the spotlight has moved on. But it’s not rejection. It’s a natural shift. Before, everyone cheered for your pitch. Now, the focus quietly shifts to how you build. That silence isn’t personal. It’s just part of the new phase.

Give yourself structure

On Monday morning, jot down three non-negotiables: how much runway you have, what your customers are saying, and what your team needs to stay sane and sharp. Even in chaos, these give you something solid to hold on to. Small, focused goals for the week can feel like progress. And progress is fuel.

Send short updates

You don’t need a polished report or a glowing story. A simple message with updates, roadblocks, and next steps is enough. It shows you’re engaged, aware, and thinking ahead. That alone keeps investor confidence intact. Most of all, it reminds you that you’re still steering the ship.

Create your pause button

Stillness is underrated. Whether it’s a quiet coffee on the balcony, a 15-minute walk, or just shutting your laptop and breathing, find a moment to unplug. Mental space isn’t a luxury. It’s a tool for better decisions and emotional survival.

Don’t try to brave it alone

Text a founder friend. DM someone you admire. Ask your investor to introduce you to someone who’s been in your shoes. No one builds in isolation. Pretending you have to only makes it harder. Just one real conversation can lift a week’s worth of mental weight.

The Middle Isn’t Failure. It’s Where the Real Work Begins

Raising money isn’t the end of your journey. In many ways, it’s where the real work begins. The stillness you’re feeling right now isn’t people walking away. It’s the shift from being pursued to being responsible, from having potential to being expected to perform. And yes, it can feel incredibly lonely, like the spotlight has moved on and now it’s just you and the weight of what comes next.

But here’s what most people don’t realise. Some of your best decisions will come during this phase. The quiet stretch, where no one is clapping, no one is watching, and you’re still showing up every day to build. This is the messy middle. It’s not a setback. It’s where the real foundation gets laid.