India’s Silent Unicorns: What They’re Doing Differently in 2025

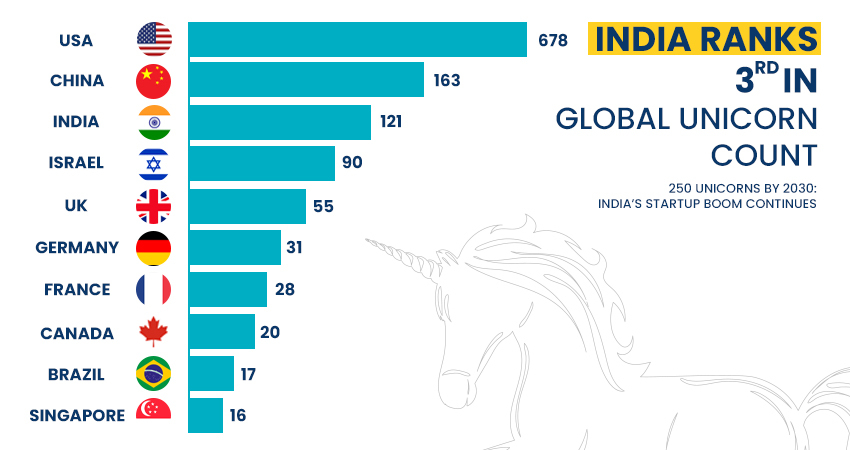

India’s startup ecosystem is growing at a remarkable pace. As of July 2025, the country ranks third globally with over 121 unicorns, according to data from the Economic Times. While many of these startups have captured public attention with flashy announcements and billion-dollar funding rounds, another group has been quietly building significant value. These are India’s silent unicorns, which include companies that may not make headlines every week but are achieving sustainable and long-term growth.

In this blog, let’s take a closer look at what these low-profile winners are doing differently and what early-stage founders can learn from them.

Building Businesses That Make Money, Not Just Raise It

One of the most visible shifts among these companies is a strong focus on profitability. Instead of chasing high valuations through constant fundraising, silent unicorns are paying attention to what matters, such as sound unit economics, cost control, and a clear path to profits.

Take Netradyne, for example. This AI-driven fleet safety startup, backed by SoftBank, quietly became India’s first unicorn of 2025 after raising around ₹749.25 crore in its Series D funding round led by existing backer Point72 Private Investments. What’s impressive is that they expect to be profitable this year. Then there’s Porter, the logistics player. They raised ₹1,665 crore recently in a Series F funding round, achieving unicorn status with a valuation of ₹9,990 crore, but not to splash on flashy brand campaigns or reckless expansion. Their goal? Sustainable growth and better margins.

This tells us something important. Founders no longer need to burn capital aggressively to grow. Many of today’s successful startups are proving that if you focus on strong unit economics and profitability, you can still attract top-quality investors.

Fixing the Core Before Scaling New Things

Another thing that sets these silent unicorns apart is their ability to stay focused. They’re not in a rush to do everything at once. Instead of chasing the next big feature or expanding into every new market, they’re doubling down on what’s already working. While others scramble to launch something new every quarter, these companies are saying, “Let’s fix what we’ve started. Let’s get this right first.” It’s a quieter, more disciplined approach and honestly, a smarter one.

Take Gupshup, for instance. The conversational AI platform recently raised around $60M (₹500 crore). But instead of splurging on a fancy new product, they’re using it to scale their existing AI capabilities and carefully expand into international markets. Their strategy is a solid reminder: doing fewer things, but doing them well, can take you much further than trying to be everywhere at once. The company managed to scale operations after tripling its revenue since 2021, all without chasing hype or announcing flashy valuations.

Designing Solutions That Fit the Indian Context

A big differentiator for these quiet performers is their deep understanding of the Indian market. Instead of replicating models from Silicon Valley, they are building businesses that are rooted in Indian consumer behaviour, infrastructure challenges, and cultural nuances.

Pristyn Care is a standout example of this India-first approach. It’s a health-tech company that has built a hybrid network of 700 partner hospitals and 100 in-house clinics. They specifically serve patients from Tier 1 and Tier 2 cities who want easy access to safe, minimally invasive surgeries. And it’s working. Their revenue jumped by 45% in FY23, showing that when you build for the real India, the results can be massive.

Then there’s Dhan, a user-first stock trading and investing platform designed specifically for Indian retail users. Its intuitive interface, integrated tools like charting and margin trading, and zero-accounting fees make it especially friendly for first-time investors. In FY 24, Dhan turned profitable, posting a net profit of ₹177 crore on revenues that surged by 689% compared to the previous year. This stellar performance underscores how culturally relevant, accessible fintech solutions can not only attract users but also retain and delight them.

Hiring for Depth, Not Just Scale

While many fast-growing startups are known for scaling their teams rapidly, silent unicorns are taking a more thoughtful approach to hiring. Their focus is on bringing in talent that understands the business, is aligned with long-term goals, and adds real value from day one.

It’s not about building a big team to look impressive. It’s about creating the right team. These companies are putting together lean, focused, mission-driven groups that grow steadily, not just for the sake of growth, but with purpose. The result? A stronger, more resilient culture where people aren’t just clocking in, they’re genuinely invested in where the company’s headed.

In fact, according to a report by RazorpayX and Peak XV (formerly Sequoia India), around 61% of early-stage startups in India reduced hiring activity in 2024, focusing instead on improving team quality and productivity. This signals a shift from vanity hiring to value-based hiring, especially in a capital-conscious environment.

And that’s an important takeaway for any founder: it’s not about how many people you hire, but who you hire. Because in the long run, quality always beats quantity.

Letting Work Speak Louder Than PR

One of the most interesting things about these companies is that they don’t crave the paid spotlight. You won’t see them making headlines every other week or chasing awards and social media buzz. Instead, they quietly go about their work and let their product, growth, and impact do the talking.

Take Gupshup, for example. You won’t see it chasing headlines or making noise on social media. But behind the scenes, it’s been quietly building something solid. In FY23, the conversational messaging platform clocked ₹1,619 crore in revenue and ₹49 crore in profit. That’s a 43% jump in revenue and over 22% growth in profits compared to the previous year. All this while deliberately staying low-key and letting execution do the talking, without relying on PR, publicity, or buzz.

And honestly, that’s a smart move. In today’s world of viral hype and burnout, keeping a low profile and focusing on execution instead of PR helps them stay grounded and credible. It’s a reminder that sometimes, the quietest players are the ones building the strongest foundations.

The Size of the Silent Unicorn Wave

According to industry trackers, at least 36 startups crossed the $1 billion (₹8,325 crore) valuation mark quietly in just the first half of 2025. These include businesses in fintech, deep tech, health tech, and enterprise SaaS.

In total, India’s startup ecosystem pulled in around (₹47,452.5 crore) $5.7 billion across nearly 470 deals during this period. Five new unicorns emerged, and by the looks of it, many more are on the way before the year wraps up.

But here’s what’s interesting: for the first time, startups raised more money from public markets, through IPOs and QIPs, than from private late-stage Venture Capital. That’s a big signal. Investors are leaning towards more mature, revenue-focused businesses instead of just betting on future potential. It’s another sign that the ecosystem is shifting towards measured growth and real outcomes.

What Founders Can Learn

If you’re building a startup today, especially in a market where every rupee counts, there’s a lot to learn from how these silent unicorns are doing things. Here are a few key takeaways from their playbook:

Nail the basics first.

Focus on building a product that customers are willing to pay for. Healthy unit economics and a clear path to profitability matter more today than just chasing user numbers.

Know your market inside out.

Understand who your customers are, where they come from, and what they really need. Building with local insights leads to more sustainable businesses.

Prioritise depth before expansion.

Try to fix what’s broken internally, improve customer retention, and make sure you’re consistently delivering value before trying to expand across new cities or sectors.

Hire people who truly fit the mission.

Bring in folks who believe in your vision and are ready to grow with you. Skip the vanity hires just to look big.

Let your work do the talking.

You don’t need to be in the news every other week. If your numbers, product, and impact are solid, the right people will notice automatically.

Final Thoughts

India’s silent unicorns may not be chasing the spotlight, but they’re quietly building businesses that are built to last. In 2025, what sets them apart is their clarity and a sharp focus on profitability, product depth, market fit, and long-term thinking.

For every founder looking to scale with purpose, this is your cue to pause and reflect. In this post-hype phase of the startup world, success isn’t about how loud you are; instead, it’s about how well you solve real problems, how wisely you manage your resources, and how consistently you show up.

Sometimes, quiet execution says more than any PR campaign ever could, and with which you can make the loudest statement.