The week after Diwali has its own sound. The fireworks are gone; the tape gun in the warehouse is suddenly the loudest thing in the building. For e-commerce, this is when the festive spike gives way to returns, RTOs, and refund queues—the quieter half of the season where operations matter more than ads. Sales charts look like a mountain range, then the slope begins; parcels circling back, refunds in queue, and shelves filling with items that need a second chance.

This is the stretch that decides whether a great season becomes a strong quarter or a cash squeeze you feel until January. From where we sit, the brands that travel well through this period move on facts, keep customers close on the channels they actually use, and let the dull, repetitive work run on rails instead of wearing people out.

Post-Diwali Returns in India 2025: Gross Merchandise Value (GMV), Returns & Return to Origin (RTO) Trends

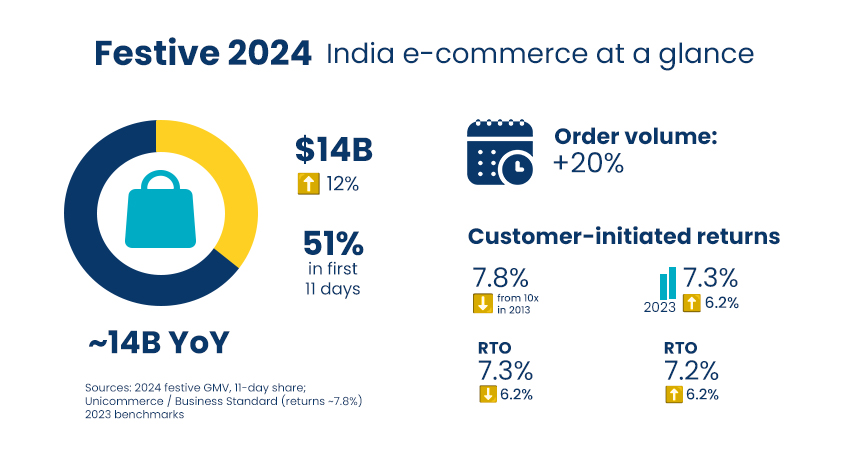

A little context helps. India’s festive e-commerce in 2025 crossed ₹60,000+ crore GMV in the first 11 days (≈3.5× BAU), up ~20–22% YoY; post-Diwali wrap-ups indicate order volumes up ~24% YoY and GMV up ~23%. Full-season GMV was projected around ₹1.15 lakh crore, nearly 20–25% YoY, almost double 2024’s pace.

The returns picture remains category-skewed: industry baselines cluster around the mid-teens (≈15–20%) for customer-initiated returns, with fashion being higher. The bigger swing factor is RTO: about 26% of COD shipments bounce back vs. <2% for prepaid, so shifting the mix to prepaid meaningfully eases cash-cycle stress. That’s why cash can feel tight even when “returns” on delivered orders look better on paper.

Returns aren’t just a policy; they’re a cost line. Once you add reverse miles, inspection, repackaging, markdown, and support time, processing can run ~20–65% of the item’s value. At an Indian scale, that pipe is an industry in itself—reverse logistics was valued at ~USD 33.2 billion in 2024 and is projected to reach ~USD 57.5 billion by 2033. The design task is simple to say, harder to do: avoid what you can, and turn the rest into same-day resale.

How Brands Steady the Week After Diwali: Prevent RTO, Save Exchanges, Speed Grading

None of this is about grand gestures. It’s a chain of small moments done right.

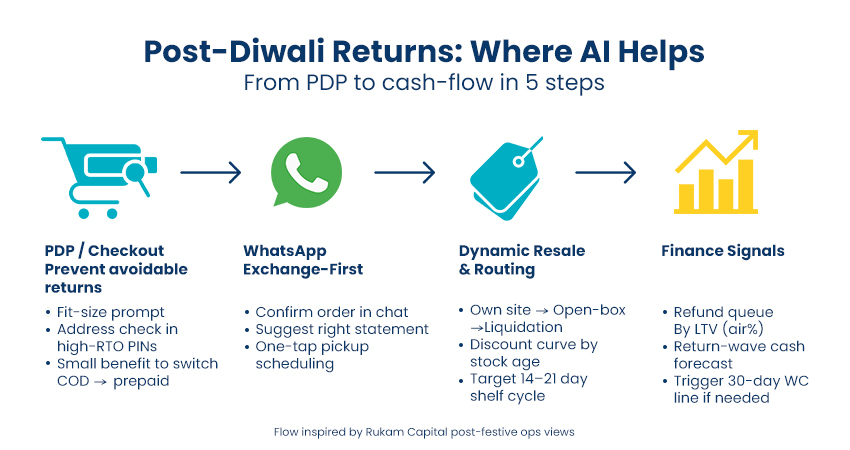

Before checkout, a few quiet rules are outlined on the page. They read signals you already own COD by pincode, past size swaps, basket mix, known return reasons, and nudge the next step. For apparel, that might be a fit prompt at the exact moment of doubt. For high-risk pins, a quick address check. For risky carts, a small perk to switch COD to prepaid. No interrogation, no drama, just a fractional drop in avoidable returns and RTO that adds up at festive volumes.

Right after a return is created, most customers start the conversation on WhatsApp. A simple chat flow can confirm the order, suggest a better size or nearby variant, and book a pickup, where exchange is first, and refund is still one tap away. Done well, this keeps revenue on your rails and protects payback on acquisition. The guardrails are plain: be clear, respect choice, and keep the refund exit easy.

In the warehouse, every minute counts. As soon as a return arrives, the team checks it with a phone camera and a short checklist. In a few clicks, the item is marked as fit to resell, refurbished, or sent for liquidation. The faster this happens, the quicker the money comes back to the business. One number matters here: how many days it takes to grade each item. Even saving a few hours can improve cash flow.

After grading, pricing, and listing should happen without delay. List the product on your own site first, then open-box if needed, and only liquidate as a last resort. Reduce the price slowly as days pass, so the stock moves quickly. Aim to sell graded products within 14 to 21 days. The goal is not to hold out for the highest price, but to move inventory fast and protect working capital.

In finance, queues can run on common sense. Sequence refunds fairly (and with a view to lifetime value), keep a short-term cash forecast of the return wave, and make a clear call on drawing a 30-day working-capital line if it smooths the dip. Handling these steps with care n calmly now can help avoid cash-flow stress in the post-season period.

We like to ground this in what we see across our portfolio companies. Sleepy Owl, for example, has been open about making service feel fast and human; co-founder Arman Sood talks through “delight at every step” in a community session on conversational support. The building blocks are straightforward, which shifts conversations to WhatsApp where customers actually reply. Automate repetitive questions and route odd cases to the right people who can resolve them. That rhythm works after Diwali: routine issues are handled in seconds, a person manages exceptions, and a sale is saved with an exchange when it fits.

Listen here: https://www.verloop.io/podcasts/customer-support-arman-sood/

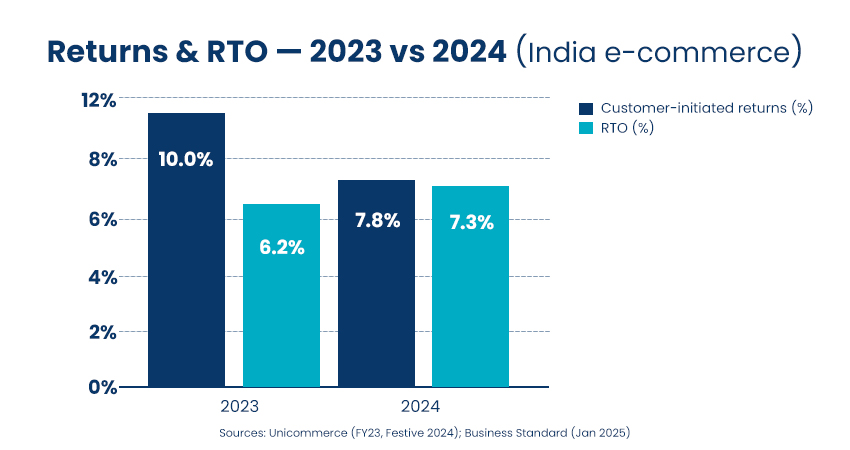

If you want a baseline for why this week matters, step back one year: return orders were ~10.4% of total sales in FY23 (compared to 9.8% in FY22), with apparel accounting for a significantly higher percentage. The 2024 drop to ~7.8% in customer-initiated returns is encouraging, resulting from clearer product descriptions, tighter sizing, and fewer “try-and-return” baskets. The catch is the RTO curve moving the other way—~7.3% in 2024 vs 6.2% in 2023, which is exactly where those behind-the-scenes rules and address hygiene earn their keep.

The dials to watch each day are small but decisive. Return rate and exchange share (move a slice of refunds into exchanges with simple WhatsApp journeys). Days-to-grade and days-to-resale (shoot for same-day grading; <14–21 days sell-through on open-box). Refund cycle time (trust and escalations live here). Reverse-logistics cost per item (negotiate post-festive slabs; reduce touches). RTO% by pincode (gate COD where risk stays high). None of this needs a platform rewrite; it needs a rhythm and a team that checks the numbers every morning.

So, here’s our core viewpoint.

Returns are the feedback in a box across our portfolio companies. In the week after Diwali, the job is to move cash faster with fewer avoidable returns up front, exchange-first chats on WhatsApp, instant grading at the dock, and pricing that gets items back into baskets quickly.

When half the festive GMV lands in eleven days, winners decide daily, not monthly. Shorter loops between a customer’s message, an ops action, and money back in motion—that’s what compounds.

Put simply, the second act of the season is where steady brands pull ahead. The companies we work with that guide choices before checkout, steer to exchange when it makes sense, grade instantly, price with intent, and keep conversations in fast channels reach January with working capital intact and customers still with them. The rest of the year is repetition with better rhythm.