From Bharat to Boardroom: What Tier 2 India Is Buying in 2025

Luxury’s new address isn’t Delhi or Mumbai. It’s Tier 2 India, where consumer trends are being rewritten daily. A stroll through the bustling centers of Lucknow, Indore, or Coimbatore will reveal a different story of consumer evolution. Families are no longer limiting themselves to the grocery basket; they are throwing in premium appliances, intelligent gadgets, and even luxury fragrances into their shopping carts. Young professionals are trying high-tech wearables, fitness subscriptions, and aspirational brands they once admired from afar.

With Rakhi celebrations and the Independence Day sales period looming, Tier-2 India is no longer a passive market. It is upgrading, testing, and setting the tone for the next wave of consumption. Let’s discover what people are buying and why this matters to forward-thinking brands.

1. FMCG & Durables: From Daily Needs to Lifestyle Upgrades

In cities like Jaipur and Ludhiana, FMCG purchases are shifting from price-driven essentials to quality-led, branded products. According to the CMS Consumption Report, durable goods spending surged by 72% in FY25, compared to just 6% in FY24. This jump signals rising disposable incomes and a strong inclination toward lifestyle upgrades.

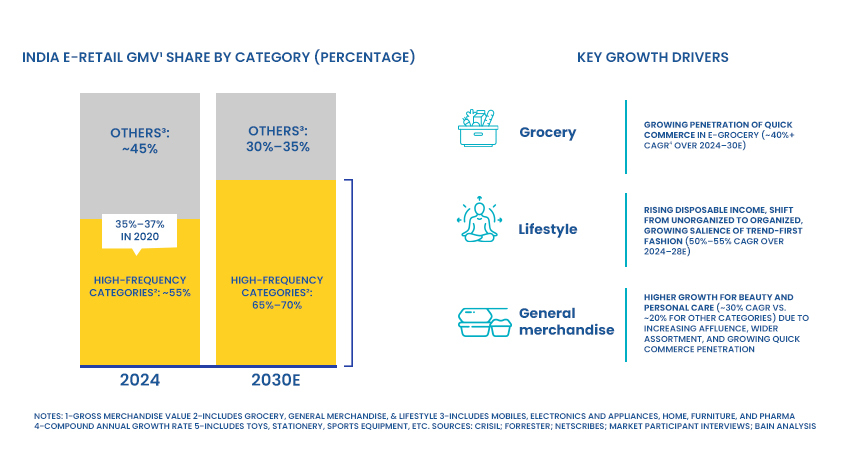

The FMCG segment is also undergoing a shift toward premiumisation. Consumers are moving from unbranded staples to wellness-centric products such as liquid detergents, organic foods, and skincare. With 63% of e-commerce orders now originating from Tier-2 and Tier-3 towns, it is evident that demand for high-quality products is no longer metro-exclusive.

Rolex in Ajmer. Mulberry in Aligarh. Bulgari in Etah. Sounds unlikely? Not anymore. From pre-owned luxury watches to limited-edition pens and handbags, Tier 2 and 3 cities are snapping up high-end products like never before. With platforms like Tata CLiQ Luxury and Luxepolis confirming over 50% of their sales now come from non-metro markets, India’s premium appetite is clearly getting more democratic and more digital.

2. E-Commerce & Quick Commerce: Speed Meets Aspirations

Tier-2 consumers have not only embraced online shopping but are also shaping the next phase of e-commerce growth. PwC India notes that these consumers spend more time and money online than metro shoppers, particularly on premium fashion, home goods, and wellness products.

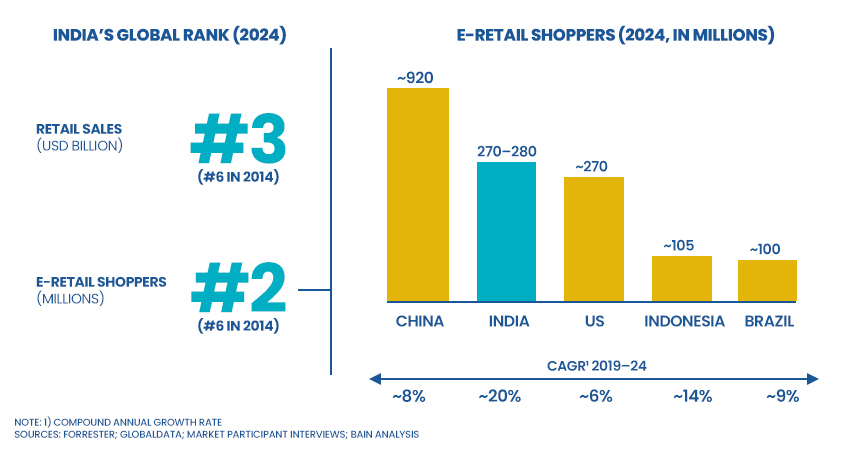

India’s e-commerce market reached $147.3 billion in 2024, with Tier-2 and Tier-3 cities contributing 60% of the business. This segment is projected to grow at approximately 19% CAGR through 2028. These buyers are not bargain hunters; they are aspirational, seeking access to brands that reflect a premium lifestyle.

Quick commerce platforms such as Blinkit and Zepto are expanding aggressively in these regions. With their 15–30-minute delivery promise, they are becoming a natural choice during festive seasons, where convenience and speed are paramount.

3. Digital Luxury in Tier-2: Where Access Meets Aspiration

India’s luxury market is expected to reach $8.5 billion by the end of 2025, with around 35% share coming from middle-class buyers in Tier-2 cities. From premium watches to smart home tech, even Indian pre-owned luxury is growing fast, with that segment projected to touch $1.56 billion by 2032.

Luxury is becoming more local, not just through flagship stores but through fast and digital-first access. Shoppers in cities like Ajmer and Guwahati are no longer waiting for stores to open. They’re going online, especially during festivals, to explore brands they once only admired. Quick delivery and curated options are turning browsing into buying.

E-commerce and quick commerce are leading this shift. With 60% of online orders now coming from non-metro cities, platforms that offer express delivery and premium selections are converting intent into action. Whether it’s a festive gift or a first-salary treat, digital luxury is no longer a distant dream. It’s real, and it’s growing across Bharat.

4. Lifestyle & Experiences: The Social Spend Surge

Tier-2 India is no longer just spending; it’s curating experiences. With rising disposable incomes of ₹30,000 to ₹35,000 per month, there’s a clear shift from functional spending to social and lifestyle-driven choices.

Quick-service restaurants, artisanal cafés, and mall-based pop-ups are now weekend staples. Dining out is no longer just a meal. It has become a way to connect, share, and be seen. This social shift is backed by brands making serious moves. SOM Distilleries, for example, is investing ₹600 crore to expand premium beer production, with Tier-2 markets as the key growth lever.

Even homes are getting a lifestyle upgrade. From Kanpur to Coimbatore, consumers are opting for premium bathroom fittings from Kohler, Toto, and Hansgrohe. The trend reflects a move beyond utility toward status and self-expression.

What we’re seeing is a transformation of taste. These consumers aren’t just spending more; they’re spending with purpose. Whether it’s dining, drinking, or designing their homes, it reflects their aspirations, signals upward mobility, and focuses on achieving a better quality of life.

5. Gen Z, First Salaries & Cultural Gifting: Tradition with a Twist

Gen Z professionals in Tier-2 cities are redefining first-salary rituals. While some still invest in traditional gifts like gold or home appliances, many prefer spending on gadgets, wellness subscriptions, or even digital assets.

Broader data on young Indian earners indicates that 38–40% allocate their first salary to gifting, 24–25% prioritise savings, and around 20% choose investments or charitable contributions. These behaviours are increasingly reflected in Tier-2 urban hubs.

During festive seasons such as Rakhi or Independence Day, these evolving habits amplify. Families are blending traditional gifting with modern purchases like digital vouchers and home tech upgrades.

Summary Table: What Tier-2 Buyers Are Purchasing in 2025

| Category | What They’re Buying | Why Tier-2 Consumers Are Buying This |

| FMCG & Durables | Liquid detergents, wellness FMCG, smart TVs, washers, ACs | Higher incomes, home improvement drives, and brand trust |

| E-Commerce & Q-Commerce | Health foods, fashion, home goods | Aspiration, access to premium and fast delivery |

| Luxury / Premium | Watches, handbags (pre-loved), artisanal lighting, and bathrooms | Investment mentality, bragging rights, quality focus |

| Lifestyle & Experiences | QSR dining, beer, lifestyle stores, café pop-ups | Social outings, disposable incomes, and rising retail space |

| Gifts & Traditions | Appliances, gold, family gifts, and cultural products | Festival season, emotional value, first salary spending |

What Brands Should Do

Speak in Local Tongues

Talk to people in the language they talk at home. Use regional languages, tap into local festivals, and partner with familiar faces who already have their trust.

Deploy Hyperlocal Logistics

Quick delivery, sometimes in just a couple of hours, turns browsing into buying, especially when the festive mood kicks in. It’s not just about speed, but about matching the instant gratification expectations of today’s digital-first shopper.

Create Hybrid Retail Experiences

Pop-ups in malls or local hotspots can give people the touch-and-feel experience they still value, while online exclusives keep the buzz going.

Narrative-First Marketing

Don’t just sell products. Sell the emotion behind them. Whether it’s pride, nostalgia, or a personal milestone, stories still move people more than specs.

Offer Tiered Options

Give people a way in. Affordable premium options like a ₹3,000 coffee machine or a ₹20,000 smartwatch can open the door, while aspirational upgrades in the ₹50,000 to ₹1 lakh range show them what’s next.

Build Trust with Better After-Sales

In smaller cities, the big question isn’t just “Should I buy this?” — it’s “Who will help if something goes wrong?” Easy returns, local service points, and simple warranty policies make a big difference. A little post-purchase support goes a long way in turning one-time buyers into loyal customers.

Final Thoughts

Tier-2 India in 2025 is not a scaled-down version of metro markets. It is a self-sustaining growth engine that blends cultural depth with digital adoption and premium aspirations. With the festival season approaching, brands that prioritise authenticity, agile logistics, and consumer storytelling are best positioned to capture this momentum.

This year, shoppers from Bharat are not merely spending. They are consciously investing in experiences, lifestyle enhancements, and brands that align with their values. For any company eyeing growth, Tier-2 India is no longer optional. It is where the next chapter of India’s consumer story is being written.