On a Tuesday afternoon, two cafés on the same lane changed their chalkboards.

The first board read, “₹99 off, today only.” The queue swelled, phones went up, stories followed. By evening, the chalk was wiped and the till hummed.

Next door: “₹289, because your hour matters.” No code. No countdown. A shorter line, familiar faces. The barista knew names; the manager knew who was travelling and who wanted the stronger roast. By close, the price still stood.

One shop sold a bargain. The other sold a decision. That difference, and the discipline it takes to hold it, is the story this note wants to tell.

Price Is a Sentence, Not a Number.

Pricing isn’t back-office admin; it’s what your brand says about itself in public every day. “₹X because you feel Y, every time.” When that sentence is clear, customers buy without checking the date or hunting for codes. When it’s muddy, you end up shouting: “15% off. Final hour. Last chance.”

At Rukam, we look for the sentence and the substance behind it, a quality you can feel, the time you genuinely save, the care you actually receive. If that substance is thin, discounts become oxygen. If it’s thick, discounts become optional. That is the first fork founders must choose at brand-building speed: are we training customers to chase a bargain, or inviting them to make a decision?

From Sale to Signal

No judgment here: early-stage offers are honest fuel. You need trial, reviews, and momentum. The slide happens quietly when the offer becomes the product. You can hear it in the “quiet” weeks, turn off promos, and the graph doesn’t dip; it drops. That sound is the end demand leaving the room.

Decision-brands flip the logic. Price is not a trick; it’s a signal. The number holds because the experience earns it, a product that works, a service that shows up, time genuinely saved. You still run promotions, but they support the story rather than substitute for it.

When the value story strengthens, price stops being a subsidy and becomes a quality signal.

The Three Questions We Use at Rukam

When we look at a consumer brand, we don’t start with “how low can you go?” We start with these three, and we encourage founders to ask them about their own pricing every quarter.

1. Can you hold the price and still grow?

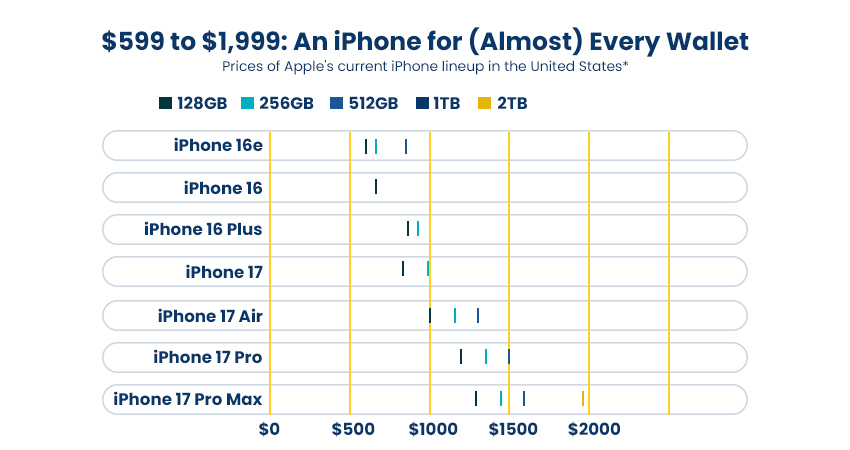

Consider Apple: across multiple iPhone cycles, it has kept average selling prices above $900 with less than 10% of total units sold under discount, yet continued to post 6–8% annual revenue growth in its flagship category. That shows value, not subsidy, is doing the heavy lifting. We call this Quiet-Week Resilience, the ability to hold price and still convert. Run a no-promo week every month. If revenue softens but doesn’t collapse, your value story is working. If it tanks, the fix isn’t louder banners; it’s a tighter offer and a better experience.

2. Does your price have a sentence?

“₹X because you feel Y, every time.” Not “₹X because our costs went up.” The sentence must point at something the customer actually feels: the fabric that doesn’t pill after ten washes, the serum that reduces irritation for 9 out of 10 users, the coffee that saves an hour of your morning. If you can’t say the sentence without a PDF, you’re negotiating, not positioning.

3. Does your pricing ladder have intent?

Every brand has rungs, even if unspoken. Make them explicit: Accessible premium is for everyday use and eases new customers in; Core is your staple, the essential offering that drives habit and margin; Specialist targets dedicated fans who want deeper value. The entry rung eases anxiety, the core rung builds routine, and the specialist rung sets your highest standard. You don’t have to be “expensive”; you have to make each rung clear and appealing.

Proof, Not Pleas

The price is not emphasised with a larger typeface. It is defended by receipts, the things customers feel and remember.

Product receipts: The obvious upgrade customers asked for (the ingredient that matters, the finish that lasts, the fit that actually fits, the grind size that suits how they brew).

Service receipts: A human reply inside two hours with an answer, not a ticket; a free fix; an alteration that saves a trip.

Time receipts: One fewer step in the journey, fewer taps, fewer queues, no surprise at checkout, a smarter refill that arrives before the bottle is empty.

Publish three receipts a quarter. Keep them short, specific, and clear. The more receipts you ship, the less you need to defend your price. It reframes value from “trust us” to “we did this,” and customers pay for that.

The Ladder Customers Can Climb.

If the brand is a journey, pricing is the staircase. People are happy to climb when each step tells the truth.

Accessible premium (newcomer rung): the ₹399–₹799 zone where anxiety is low and the trial is honest. In skincare, this is the discovery stage where cleansers, toners, or mini serums build trust through visible results. This rung must over-deliver.

Core (habit rung): the ₹799–₹1,999 zone where repeat lives and margins breathe. Your daily moisturiser or signature serum sits here, the product that defines your taste and keeps your user coming back. Do not dilute it.

Specialist (belief rung): ₹1,999+ where the believer lives and your ceiling is proven. Think intensive treatments or limited-edition formulas that showcase expertise and reward loyalty. Fewer buyers, deeper trust, clearer signal.

(Indicative price ranges shown for illustration; actual bands may vary by category, audience, and brand positioning.)

Your category may demand different bands, but the principle holds. Decide the rungs, design the products and benefits for each, and stick to your rung. It’s better to be the best in a clear band than to swing across brackets with codes.

(Make the rungs explicit. Customers climb willingly when each step is honest and well-designed.)

The No-Casino Calendar

Perpetual strike-throughs teach customers to wait. If every week is a tent-pole, none is. Swap the slot machine for rules that feel grown-up and brand-true:

Bundles that finish a job, not blunt sitewide percentages. Pair the things that make the whole experience work: shirt + alteration, serum + moisturiser, grinder + beans, and reward completion, not indiscriminate spending.

Utilities over discounts: free repair, a refill week, priority slots, and extended support. People are happy to pay full price when what they’re buying is certain.

Early access is a privilege, not a permanent code. Certainty beats subsidy for customers who already believe.

This isn’t anti-promotion; it’s pro-trust. You’re trading sugar for protein.

Silence Week: A Habit for Grown Brands

Pick one week a month and announce it internally as Silence Week. No sitewide promos. The media stays on, but not spiky. Watch four numbers:

Revenue per visit – do customers still convert without the nudge?

Conversion rate – are you selling the offer or the offerer?

Repeat without coupons – are your loyalists loyal to you or to the code?

Support load and resolution time – are you earning a price with responsiveness?

If the chart dips slightly, you’ve found a good price. If it tanks, don’t panic. Ship a receipt and try again next month. Momentum is a habit, not a hack.

Channels: Reach vs Narrative

Marketplaces are excellent at reach. Let them do that job. But your narrative, why ₹X exists, lives on your site, your stores, your packaging, and your CRM. Join the big tent-poles, but avoid living under a permanent red slash. When quick-delivery platforms nudge you towards price games, remember: convenience is a feature; worth is the brand.

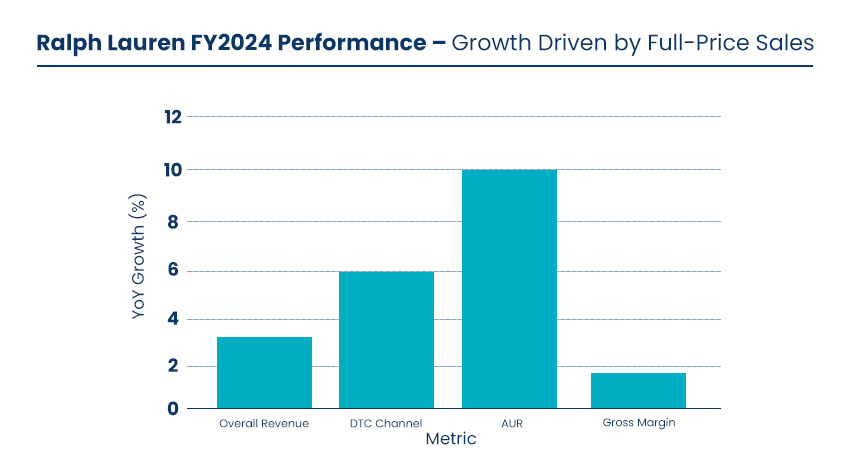

Ralph Lauren is a clear example. In fiscal year 2024, the brand’s direct-to-consumer (DTC) channel grew 6%, driven by full-price sales and an 11% rise in average unit retail (AUR). Meanwhile, overall revenue increased 3%, and the company reported gross margin gains from reduced discounting and stronger pricing discipline. The message is simple: when your MRP holds meaning on your own surfaces, the code stops being the hook. Advertising then amplifies a healthy engine instead of keeping it alive.

The Rukam Stance (How We Evaluate and How You Can Self-Check)

When we back a consumer brand, we don’t ask, “Can you drop the price and grow?” We ask, “Can you hold the price and grow?” It is a quieter question, but it correlates better with durability. Three simple checks:

Quiet-Week Resilience: With promos off, revenue softens, not collapses. If it collapses, the fix is not creative; it’s value.

MRP Integrity: The majority of orders close at the list or close to it. Strike-throughs are occasional, not a default state.

Receipt Velocity: Receipt Velocity measures how quickly customers receive and register visible improvements from your brand. It is not about release notes or social updates, but about felt progress like faster service, better packaging, and smoother journeys. If customers can name the last three changes without checking your Instagram, you’re in decision territory.

A final internal lens we like: Brand search vs. founder search. When your brand starts winning on its own name, you reduce key-person risk and make your price story bigger than any single voice. A decision-brand grows under many hands.

Closing: Be the Decision

Anyone can sell a bargain for a day. Building a decision takes longer, then lasts longer. Write the sentence your price speaks. Ship the receipts that prove it. Make the ladder explicit and keep each rung honest. Run Silence Week until the dips become lines. Let marketplaces give you reach, but keep the meaning at home.

When customers pay your price without opening the coupon drawer, you’ve crossed the lane. You’re no longer waiting for demand to happen; you’re chosen, and chosen brands compound.