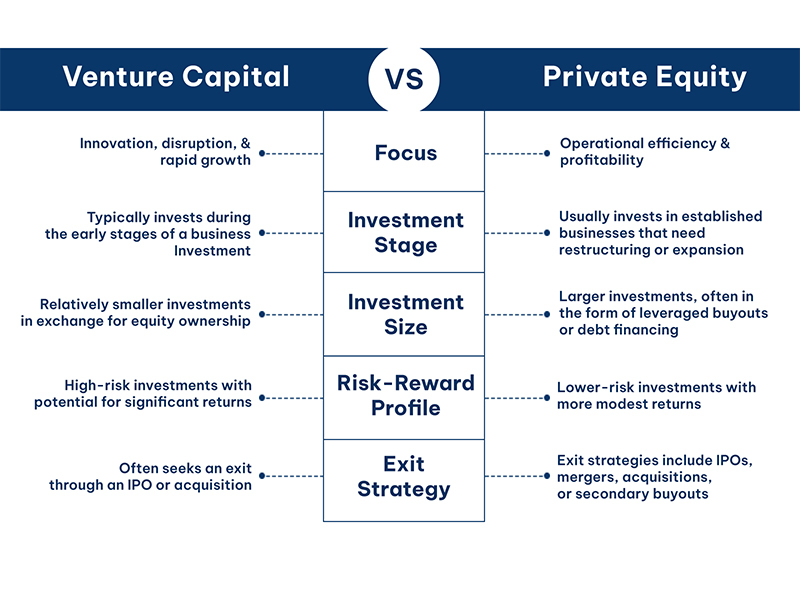

If you’re building a company in India in 2025, you’ll probably meet Venture Capital firms (VC) and private equity (PE) deal-makers. At first glance, they appear similar: both write cheques, sit on boards, and are tech-savvy. However, beyond the initial impressions, there are significant differences in mandates, timelines, risk appetites, and implications for you, the founder.

This deep dive unpacks those differences, grounds them in the latest Indian data and regulations, and ends with a decision framework you can use.

1. Market snapshot: where the money is in 2024-25

- VC is thawing after a funding winter.

According to a report, Indian VC funding rebounded 43% to US$ 13.7 billion in 2024, with deal volumes up ~45% to 1,270. Quick-commerce stars like Zepto and B2C platforms like Meesho led the charge, with five new unicorns emerging.

- Private Equity stayed resilient.

Overall, Private Equity-Venture Capital (PE-VC) investments declined in 2023, but Private Equity deals fell by about 20%, whereas Venture Capital firms experienced a 60% decline.

- Momentum returned in Q1 2025

Private Equity (PE) and Venture Capital investments totalled US$13.7 billion across 284 deals, with buyouts dominating at US$5.2 billion.

2. How do deal structures differ for founders

- Security types

Venture Capital Firms: Preference shares, SAFE/convertible notes early on, later Series A/B priced rounds.

Private Equity (PE): straight equity plus shareholder loans, structured preference shares with ratchets, or leveraged buy-outs.

- Dilution vs. control

Venture Capital typically caps founder dilution per round at 10-20%, preserving your psychological ownership. PE often exceeds 51% for control; founders may stay on as CEO with an earn-out or transition to professional management.

- Governance

Venture Capital term sheets focus on protective provisions, including anti-dilution, tag-along, and liquidation preferences. PE adds affirmative control through budgets, hiring and firing of CXOs, dividend policy, and debt caps.

- Due-diligence depth

Venture Capital diligence is typically fast, with a duration of under 4-6 weeks, and forward-looking, focusing on market size and team.

Private Equity diligence is forensic. It involves the quality of earnings, forensic accounting, legal liens, ESG, and deep customer interviews. The process takes around 8-12 weeks.

3. The regulatory lens founders can’t ignore

- SEBI’s AIF (Alternative Investment Funds) playbook

- Venture Capital Funds (Cat I) enjoy concessional treatment, lighter leverage rules, and certain tax pass-through benefits.

- PE/Growth Funds fall under Category II, which requires no leverage but stricter valuation and disclosure norms.

- Tightened governance across the board by SEBI

- Valuation overhaul (Sept 2024). AIFs must now value unlisted securities using IPEV guidelines instead of Mutual Fund rules, and changes in methodology no longer trigger an exit option for dissenting LPs (Limited Partners).

- Dematerialised units (Oct 2024). All new AIF units must be in demat form, easing secondary transfers.

For founders, the practical takeaway is cleaner cap tables and more transparent price discovery, especially in follow-on rounds where Private Equity investors benchmark exits to fair-value reports.

4. Deciding which capital is right for you

- Stage & risk profile

Pre-product/early revenue? Venture Capital firms are almost the only game in town.

EBITDA-positive, ₹200+ crore revenue? PE phones start ringing.

- Growth vs. liquidity

A Venture Capital risk appetite fits the bill if the goal is blitz-scaling without immediate profitability. A Private Equity growth cheque or structured secondary can work if you want a partial cash-out for early shareholders while fuelling the next leg.

- Control preference

Founders who want to steer a long-term vision should be aware of most Private Equity deals. However, if operational excellence and exit certainty take precedence over founder control, Private Equity can professionalise and unlock value quickly.

- Time horizon & exit expectations

Venture Capital-backed companies tend to lean toward IPOs or strategic sales after a 7-to 10-year climb. PE investors often pre-agree exit routes (secondary to another PE, trade sale, or IPO) within five years; earn-outs are common.

- Sector signalling

Deep-tech, SaaS, and consumer internet are magnets for venture Capital. Manufacturing, healthcare services, renewables, and traditional FMCG brands attract PE’s cash-flow lenses.

5. Negotiating tips for Indian founders

- Clean up compliance early

Both Venture Capital firms and Private Equity firms now insist on GST, PF/ESIC, and ROC filings in order. Loose ends kill deals.

- Think governance dashboards

Pre-build MIS, CFO function, and ESOP administration; Private Equity treats these as hygiene.

- Align on the use-of-funds story

Venture Capital firms tend to favour ambitious R&D and market-capture budgets, while Private Equity focuses on capital expenditures, working capital efficiency, and bolt-on mergers and acquisitions. Tailor your pitch accordingly.

- Plan for follow-ups

Private Equity often seeks a right of first offer on future rounds; Venture Capital firms fight for pro-rata rights. Model dilution scenarios before signing.

- Negotiate liquidation preferences smartly

A 1x non-participating preference is standard in Venture Capital. Private Equity might push for participating or ratchet structures tied to the Internal Rate of Return (IRR). Small tweaks today can save millions at exit.

6. A quick decision matrix

| Question | Answer | What’s Suitable? |

| Do I need ₹50 crore to blitz nationwide expansion with negative EBITDA? | Yes | Venture Capital |

| Am I ready to sell 60 % of my profitable D2C brand to scale globally? | Yes | Growth Private Equity |

| Is my core asset infra/heavy-capex with predictable cash flows? | Yes | Private Equity or infrastructure funds |

| Do I value keeping board control above maximising cheque size? | Yes | Venture Capital or minority Private Equity |

| Do I want some personal liquidity today? | Yes | Private Equity secondary or structured round |

The Final Word

India’s funding landscape is no longer binary; it’s a spectrum. Venture Capital and Private Equity now overlap in late-growth rounds, and family offices or sovereign funds often play both games. But understanding the classical differences remains crucial:

- A Venture Capital firm will bet on your dream; Private Equity (PE) will buy into your cash flows.

- Venture Capitalists will help you increase users by 10x; a Private Equity firm will help you with a 2x EBITDA.

- Venture Capital firms want the next unicorn. Private Equity wants the next IPO prospect.

Neither is “better” — only better suited to where your company is today and where you, the founder, want to be tomorrow. Use the frameworks above, consult with mentors who have walked both paths, and select a partner that aligns with your vision, risk appetite, and timeline. Happy fundraising — and may your cap-table always stay founder-friendly.