In India’s evolving startup ecosystem, Venture Capital is more than a financier. Venture investing isn’t just about finding the next unicorn; it’s about nurturing long-term value by backing founders with clarity of thought, conviction in purpose, and the discipline to execute. At Rukam Capital, we believe the real story begins after the first cheque.

Why Early Capital Matters, But Isn’t The Whole Picture

| Purpose | Why It Matters |

| MVP Development | Validates the core product with early users |

| Team Hiring | Brings in initial talent for product & ops |

| Market Research | Tests demand, pricing, and competition |

| Branding & Go-to-Market | Creates identity and visibility in target markets |

| Infrastructure Setup | Covers software, logistics, and early operations |

Seed funding helps de-risk innovation. It gives founders room to build, iterate, and test product-market fit. But funding is only one dimension of startup success. Just as important is the founder’s ability to learn, unlearn, and build with focus.

| Source | Description |

| Angel Investors | Experienced entrepreneurs or professionals who offer capital and mentorship. |

| Venture Capital Firms | Firms like Rukam Capital, which bring structured capital and strategic guidance. |

| Incubators & Accelerators | Programs offering support, mentoring, and seed capital. |

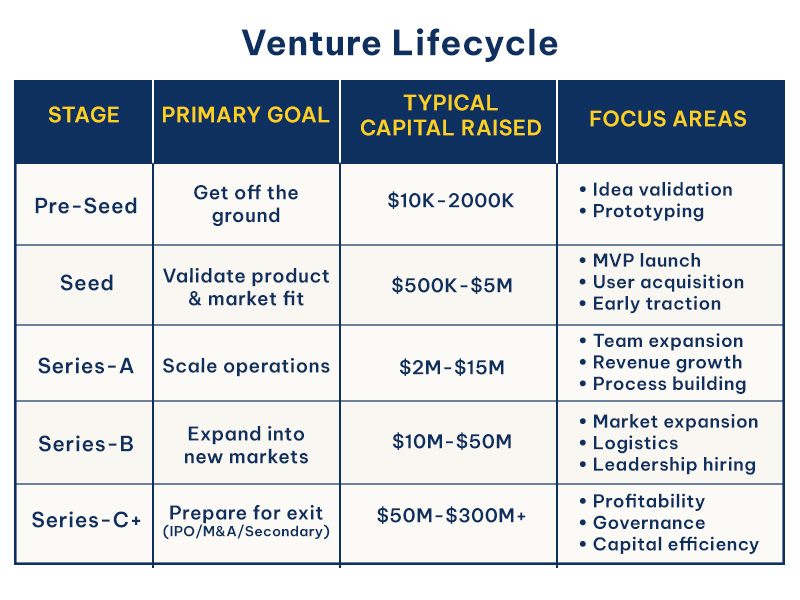

Mapping the Venture Lifecycle in India

The journey of a startup is rarely straightforward. It moves in phases, marked by distinct funding rounds that each demand a shift in mindset, execution, and expectations.

It all begins with pre-seed/seed. A passionate founder has a little more than an idea and a belief in solving a problem. For investors, this is the riskiest bet. With no metrics to lean on, they evaluate clarity of purpose, the founder’s understanding of the market, and the ability to build amid uncertainty. It’s where conviction matters most.

Series A brings a new kind of pressure. The product is in place, early signs of traction are visible, and now the challenge is scale. Founders must show they can move from building to growing, strengthening teams, refining distribution, and tightening operations. Investors at this stage look for a clear strategy, early proof points, and the discipline to execute.

With Series B and later rounds, the focus turns to acceleration. The basics are no longer enough. Startups are expected to enter new markets, enhance infrastructure, and professionalize leadership. Investments here are larger, but so is the scrutiny on margins, governance, and the ability to sustain growth at scale.

By the time a company reaches Series C and beyond, the conversation shifts entirely. It’s no longer about potential—it’s about exit. Investors want to see a well-defined path to it, whether through an IPO, a strategic acquisition, or a secondary sale. At this stage, capital comes with expectations around timelines, transparency, and returns. Exit math isn’t a future concern, it’s baked into every decision from here on.

Real-World Signals: How Rukam-Backed Founders Are Scaling With Intent

Behind every growth metric is a founder making bold, strategic choices. Take a look at real-world traction from Rukam Capital’s portfolio, which features founders who aren’t just chasing valuation but building with clarity, sustainability, and long-term value in mind.

🟢 Curefoods

| Growth Levers | Status Update |

| Brand Consolidation | Evolved from cloud kitchen to multi-brand F&B |

| Exit Preparation | Received IPO approval (April 2025) |

| Next Milestone | Targeting $300–400M raise in FY26 |

🟡 Go Desi

| Differentiator | Strategic Opportunity |

| Ethnic Snacks Positioning | Attracting M&A interest from large FMCG players |

| Regional Brand Strength | Plug-and-play value for cultural resonance |

🟣 Beco & Indus Valley

| Sustainability Focus | Strategic Movement |

| Eco-conscious positioning | Gaining traction in clean living markets |

| Partial Secondaries | Demonstrates investor confidence and growth readiness |

These outcomes didn’t happen by chance. They were planned, modeled, and built toward.

Do You Really Need Seed Capital for Your Startup?

Not always. For some founders, early-stage funding isn’t a necessity. Those with personal capital, strong networks, or the ability to sustain operations on revenue may choose to bootstrap and maintain full control while building at their own pace.

| So If You Have… | Then… |

| Personal savings | Consider bootstrapping an MVP |

| Strong networks | Leverage advisory capital & sweat equity |

| Product-market clarity | Seek Series A directly |

| But if You Lack… | Then Seed Funding Is… |

| Resources | A chance to build with credibility |

| Mentorship | A path to experienced guidance |

| Exposure | A way to access networks & partnerships |

Final Word

India’s Venture Capital ecosystem is evolving. It’s no longer about chasing the next big trend but building with balance. Whether you’re raising your first round or planning a public debut, ask not just how much to raise, but why, from whom, and to what end.

“The best founders don’t just chase capital. They choose partners who match their pace, purpose, and principles.” – Rukam Capital