Venture capital (VC) today is much more than money; it’s a driving force shaping India’s emerging economic narrative. For early-stage founders who are seriously building, understanding how VCs work, where they flow capital, and why it matters for national growth isn’t just useful, it’s essential. Here’s a thoughtful, grounded look at VC’s role in India’s economy today, in clear and practical terms.

VC in India: The Numbers That Speak

Let’s open with data—it’s indisputable.

- $13.7 billion in VC funding flowed into India in 2024, a solid 40% increase over 2023

- The number of VC deals ramped from 880 in 2023 to 1,270 in 2024—a 45% jump

- Early 2025 keeps the momentum going: deal volume is up 19%, and funding value is up 20% compared to early 2024

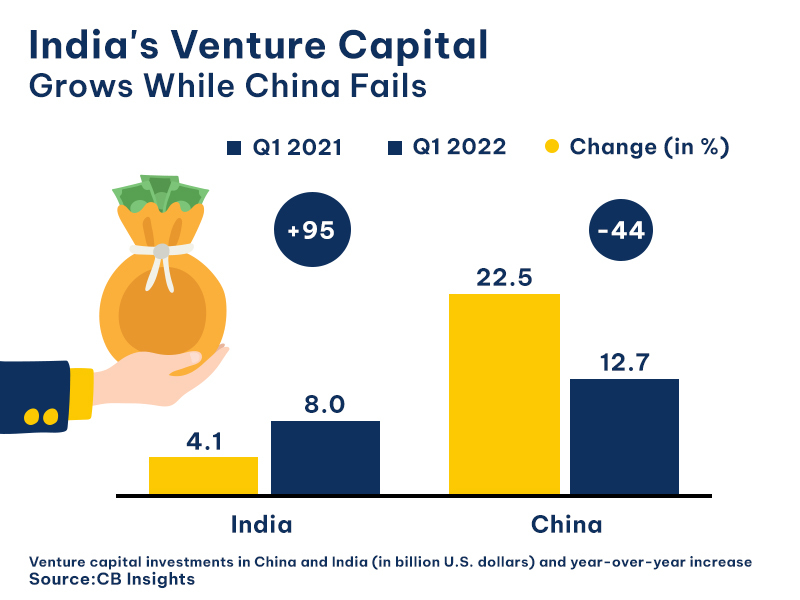

A graphical snapshot

These aren’t quick wins or hype plays. It’s a disciplined, structural uptrend.

VC’s Economic Footprint: Jobs, Innovation, GDP

VC isn’t driving growth in a silo—it’s accelerating key economic areas:

- Jobs: VC-backed startups added over 4 million new roles from 2014–2019, icicidirect.com—from product managers to UX designers, and other high-skill functions.

- Innovation: From fintech breakthroughs to enterprise SaaS and deep-tech labs, venture capital funds are backing the ideas redefining business globally.

- GDP contribution: Startups now account for 4–5% of India’s GDP, a significant increase from their early single-digit foothold.

- Global signal: India is now the #2 VC destination in the Asia-Pacific region, making it a magnet for international capital.

This is a foundational economic impact, not paper growth.

How VC Firms Work: What Founders Should Know

Here’s a simplified lifecycle—and what it means for you:

| VC Phase | Founders’ Takeaway |

| Fundraising | Funds raised from LPs (institutions, family offices)—they set the fund’s timeframe and thesis. |

| Deployment | VCs invest through seed, Series A, B, and C, targeting startups that align with their thesis. |

| Support phase | This is where VC adds value—strategic advice, hiring aid, introductions, etc. |

| Exit | Returns realised via IPOs, M&A, or secondary sales—this closes the loop. |

Funds typically run 10-year cycles, with big deployments in the first 5 years. This timeline matters—VCs aren’t in it for flash, but for fruit.

What VCs Hunt For

Let’s be real: VCs don’t fall in love with ideas alone. They bet on a few core factors:

- Domain depth: Founders who live and breathe their category.

- Market size: Enough runway to scale past single digits.

- Product moat: An idea that’s unique or defensible.

- Traction: Evidence beyond beta users—this means real usage and growth.

- Thesis alignment: Fit with the firm’s broader strategy.

At Rukam Capital, we look for founders who understand their users and growth and stay grounded in unit economics.

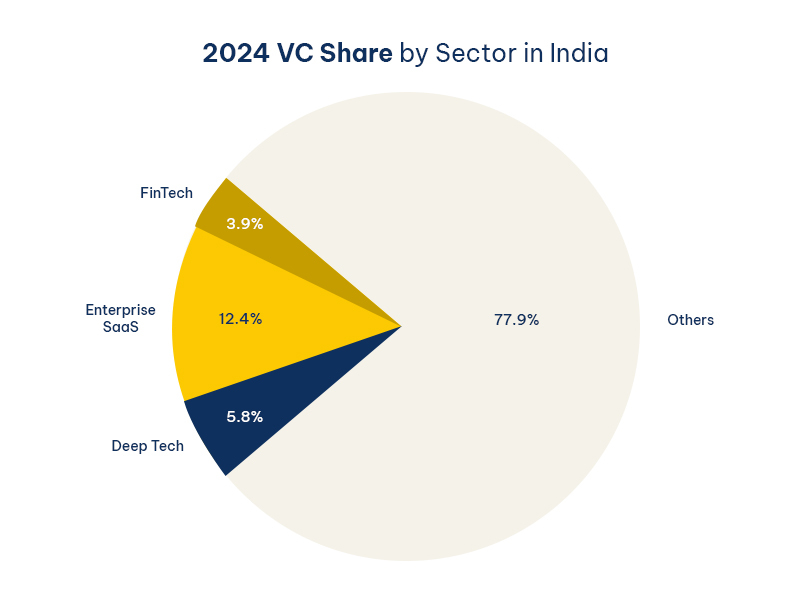

Where the Money Is Flowing—and Why It Matters

Here’s what’s attracting serious VC capital:

| Sector | 2024–25 Snapshot |

| FinTech | $531 M raised in Q1 alone; 26 unicorns ~ $90 B value |

| Enterprise SaaS | $1.7 B in 2024; driven by increased digitalisation across industries |

| Deep Tech (AI/ML) | $796 M in 2024, with strong momentum in R&D hubs |

If your business fits one of these categories—or tangentially intersects—you’ve got a seat at the table. But remember, scale matters more than trendiness.

Beyond Cheques: How Smart VCs Engage

VCs who simply invest and disappear don’t add real value. Here’s what strong partners offer:

- Strategic Insight: They help shape your narrative and your next steps.

- Hiring Support: Sourcing A-grade talent fast.

- Market Access: Opens doors to customers and scaling opportunities.

- PR Leverage: Helps amplify your brand from the outset.

- Fiscal Guardrails: Helps keep burn rates in check and maintain a healthy runway.

A great VC becomes an extension of your team, not just a bank account.

VC Risks: The Real Costs

Securing VC funding isn’t the finish line—it brings trade-offs:

- Equity dilution: Your share and control shrink.

- Milestone pressure: You must deliver or risk being eliminated in the next round.

- Market cycles: Valuations are cyclical—when they dip, so does investor sentiment.

- Focus on scale: VC may not be the best fit if your business isn’t built to scale momentum.

Ask yourself: Is acceleration worth the scrutiny and structure?

Is VC Right for Your Startup?

Here’s your checklist:

✅ Do you need to scale fast?

✅ Are you ready to share control?

✅ Is your market significant and growing?

✅ Are metrics, milestones, and scrutiny part of your DNA?

If the answer’s “yes” across the board, VC could be your fuel. If not, there’s no shame in choosing a slower, more sustainable path.

India’s Broader Growth: The Bigger Picture

A VC-fueled ecosystem is more than startups—it impacts:

- National infrastructure: Data centres, digital education, fintech roads.

- Urban and rural uplift: Startups reaching tier 2/3 cities, bringing services where they’re needed.

- Economic resilience: Diversifies revenue away from traditional sectors during global downturns.

VC doesn’t just build companies—it builds livelihoods.

Final Word

Venture capital is an engine, not a crutch. It multiplies jobs, modernises industries, and sharpens India’s global competitiveness. For founders, VC is a choice that demands clarity, resilience, and ambition.

If you’re building something with potential, depth, and a clear path to scale, understanding how venture capital (VC) works could be your compass. Not just for fundraising, but for shaping your company into what it’s meant to be.