Scroll. Swipe. Dismiss. Repeat. For India’s Gen Z, there’s no slow build—only an instant “yes” or “no.” In this world of reflexive browsing and exacting aesthetics, conventional D2C strategies are fraying at the edges. A generation steeped in algorithm-driven experiences and social consciousness demands that design, mission, and perceived worth serve as gatekeepers to engagement.

With roughly 377 million Gen Zers shaping trends and commanding approximately $860 billion in spending, their take on design, brand purpose, and what feels like genuine value can make or break a brand’s growth trajectory.

Think back to the last time you discovered a product purely because it felt authentic or because the packaging “spoke” to you. Those instincts reflect Gen Z’s mindset, and if your D2C strategy doesn’t tune into that frequency, you might miss out on a massive wave of engagement and loyalty.

Look at Sugar Cosmetics and Bombay Shaving Company, both VC-backed, consumer-centric brands that walked beyond traditional ads. Sugar Cosmetics impressed with bold, inclusive packaging and a narrative around celebrating diverse beauty, subtly signalling quality without alienating price-sensitive shoppers.

Bombay Shaving Company combined sleek, modern design with clear, transparent messaging about product ingredients and a pricing approach that felt accessible yet premium. Think about these: what makes you champion a brand? The visual identity, the story behind its origin, or the feeling that you’re getting genuine value?

It’s no longer enough to chase scale alone: Venture Capital firms are adjusting their focus toward cultural relevance, recognising that instant resonance with Gen Z can make or break a brand’s trajectory.

Why Gen Z?

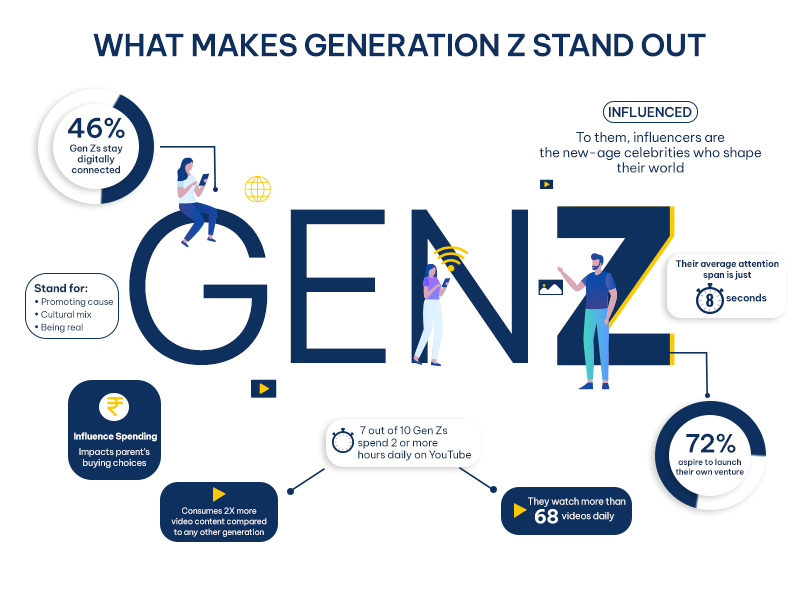

- Demographic majority: Indian Gen Z (approximately 377 million) accounts for over a quarter of the population. Nearly 1 in 4 Indians is Gen Z.

- Spending power: Gen Z in India drives an estimated $860B in consumer spending as of 2024

- Digital natives: They grew up with smartphones, social media, and e-commerce. Over 68% have ordered directly from brands (D2C) at least once.

- Value-driven: They tend to seek authenticity, sustainability, personalisation, and community engagement.

From Aesthetics to Experience: A Gen Z Understanding of Design

Visuals & UX Expectations

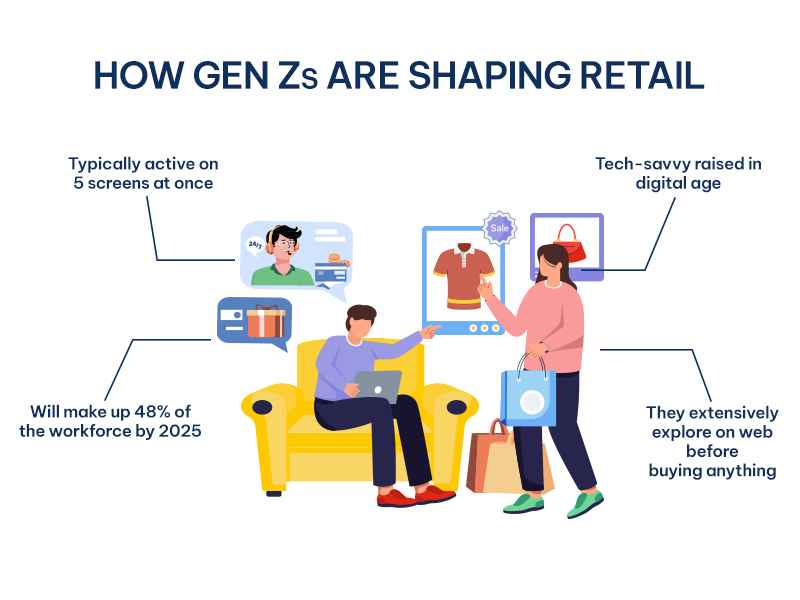

1. Sleek, mobile-first interfaces: With high smartphone penetration, websites and apps must load quickly, navigate smoothly, and have a modern appearance. Slow or cluttered experiences can lead to high bounce rates among Gen Z users.

2. Authentic aesthetics: They spot “overly polished” stock imagery vs. genuine content. Brands that showcase real users, behind-the-scenes peeks, or “day-in-the-life” visuals resonate more.

3. Interactive elements: Quizzes, polls on social media stories, AR try-ons (e.g., virtual makeup), and shoppable videos cater to Gen Z’s craving for engagement.

4. Sustainable design: Packaging that visually communicates eco-friendliness (e.g., minimalistic, recyclable materials) signals alignment with Gen Z values.

OUR TAKE:

We evaluate potential D2C investments in design excellence. Beyond a “pretty logo,” we look for brands that embed Gen Z-friendly features, such as AR previews, dynamic UGC integration, and UX optimised for quick, mobile-first interactions. We often recommend founders invest in iterative design sprints—rapid user testing with Gen Z focus groups—to fine-tune their digital and physical touchpoints.

Co-creation & Community-Led Design

1. Beta releases and feedback loops: Inviting a cohort of Gen Z users to test new product lines or app features builds loyalty and yields actionable insights.

2. Collaborations with influencers: Co-designed collections with micro-influencers or Gen Z creators can spur engagement and tap into niche communities.

3. Interactive prompts: Are there D2C brands you follow that involve customers in product design (e.g., limited-edition drops co-created with users)? How does that influence your perception of the brand?

Venture Capital Lens: What Investors Are Looking For

| Criterion | Why It Matters | Rukam Capital Insight |

| Market Size & Growth Trajectory | India’s D2C market was approximately $12B in 2022 and is projected to be over $60B by 2027 (around a 40% CAGR), indicating a large opportunity | Request that founders include a “Gen Z Insights Deck” that covers segmentation, spending trends, and growth forecasts |

| Unit Economics & CAC | Customer Acquisition Costs (CAC) among Gen Z can be high due to intense competition in social ad spending | Encourage founders to model CAC vs. LTV under different scenarios (e.g., organic vs. paid) |

| Product-Market Fit | Gen Z’s purchase inclination projects that around 68% have ordered directly from brands | Track cohort metrics, including repeat purchases and NPS for the Gen Z segment specifically |

| Pricing Models | Gen Z prioritises “value with clarity” over the lowest price, featuring transparent breakdowns, tiered or subscription offerings, and limited-edition drops for premium products | Suggest A/B testing pricing tiers or subscription bundles with Gen Z cohorts and monitor churn |

| Innovation | Emerging technologies (AR/VR, AI personalisation, Web3 loyalty tokens) may appeal strongly to Gen Z | Encourage lean pilot testing of emerging features (e.g., minimal AR try-on for select users) |

Gen Z’s Pursuit of Purpose: Beyond Products to Shared Values

For Gen Z, buying is not just a transactional act, as they seek out brands with a clear mission. They gravitate toward brands that source materials sustainably, enforce responsible manufacturing practices, and even provide clear end-of-life recycling or upcycling solutions, ensuring products don’t end up in landfills. Sustainability isn’t a bonus for them; they expect it naturally, whether through eco-friendly sourcing, ethical manufacturing, or thoughtful end-of-life recycling initiatives. Whether supporting local artisans, championing diversity and inclusion, or giving back via charitable partnerships, Gen Z tends to reward brands that stand for something bigger.

- Digital communities and platforms: Brands can host forums, Discord channels, or social media groups where Gen Z users discuss their interests, provide feedback, and form brand-centric micro-communities.

- Storytelling via authentic voices: User stories, founder diaries, “day on the ground” features that illustrate real impact. For instance, short-form videos (such as Reels, Shorts, and Stories) showing a local artisan at work can humanise the brand.

- Cause-driven activations: Limited-edition launches linked to social campaigns (e.g., product drop where proceeds go to a cause) create urgency and align with Gen Z’s desire to “vote with their wallet.”

OUR TAKE

In our due diligence, we probe a founder’s purpose narrative: Is it genuine or superficial? We look for founders who embed purpose into their business model (e.g., dedicating a certain percentage of revenue to social initiatives and utilising sustainable materials as a core, not an afterthought).

We encourage portfolio brands to publish transparent impact reports (e.g., carbon footprint, social impact metrics) and share them in digestible formats, such as brief infographics or short videos, on channels that Gen Z frequents.

THE PATH AHEAD

Gen Z’s distinctive expectations around design, purpose, and pricing are not mere buzzwords; they fundamentally reshape D2C strategies in India. Venture Capital firms like Rukam Capital view these shifts as critical filters when selecting and supporting founders. Brands that excel will:

- Deliver seamless, authentic design and user experiences catered to digital fluency.

- Embed genuine purposes, such as sustainability, social impact, and transparency, in their core, not as afterthoughts.

- Craft pricing models? Emphasise clear value, flexibility, and innovative approaches, such as subscriptions or rentals.

Throughout iterative experimentation, data-driven insights, and community-led engagement with Gen Z, these elements will form the backbone of successful D2C ventures. For founders, the roadmap involves continuous listening, agile execution, and transparent storytelling.

For investors, the focus remains on scalable, resilient business models that deeply resonate with Gen Z and deliver strong unit economics.