The VC Trends Startup Founders Must Watch

Driven by its demographic advantage and rapid digital adoption, India is an attractive global investment destination. Heightened expectations and new responsibilities for founders accompany the increase in capital flow; however, the Indian VC scene presents multiple opportunities if founders and other stakeholders understand the evolving investment landscape. Its key features are the focus on ‘Bharat’, investor emphasis on the path to profitability, the availability and terms of VC, India’s emergence on the global Software‑as‑a‑Service (SaaS) fintech innovation scene, and the maturing creator economy.

‘Bharat Wants Your Attention’

The Indian market is broadening to include the substantial population in Tier‑2, Tier‑3 cities, and rural areas, collectively referred to as “Bharat.” This demographic is distinguished by its growing digital connectivity, rising aspirations, and unique consumption patterns. Long characterized by its English‑speaking urban elite in metropolitan cities, the expanding market is attracting VC attention.

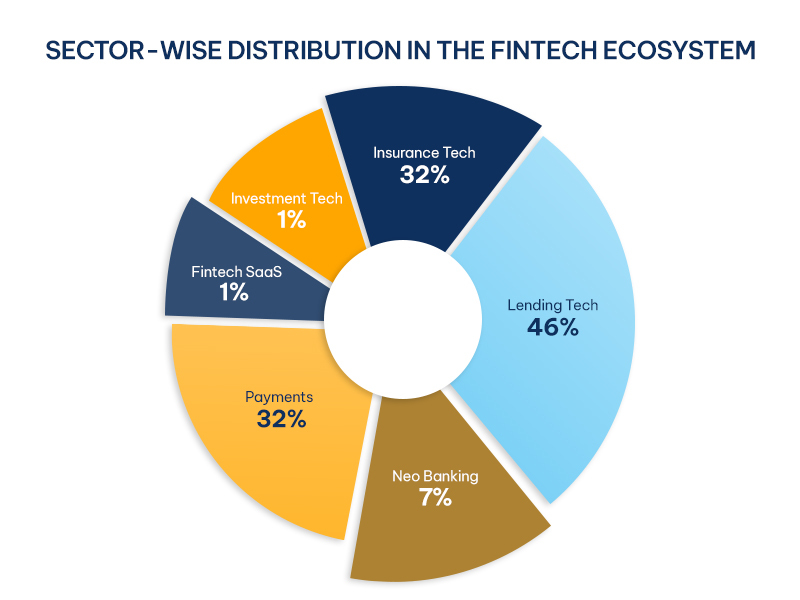

Observable growth areas include vernacular content platforms, assisted e‑commerce models emphasising trust and user support, and fintech solutions addressing micro‑credit and savings for previously underserved communities. As Fintech 2.0 moves beyond basic payment solutions to support a more inclusive financial ecosystem, the focus is on embedded finance, specialised lending for MSMEs and agricultural sectors, democratising wealth management tools, and developing accessible insurtech products for underserved populations.

The Open Network for Digital Commerce (ONDC) is expected to catalyse new fintech opportunities. VCs will be looking for startups that can build profitable and scalable models serving India’s diverse financial needs, such as micro‑credit and savings offerings for previously underserved communities.

Success for startups in engaging Bharat necessitates strategies beyond mere language localisation to encompass solutions designed with a deep understanding of regional nuances, diverse cultural contexts, and varying levels of digital literacy.

Tapping into Bharat requires patient investment, sophisticated go‑to‑market strategies, and, often, the development of new distribution channels. Founders who can connect with and develop solutions for this expansive market are increasingly likely to engage VC interest, as Bharat is a critical component of India’s current and future economic growth.

VCs Prefer Companies with Strong Foundations and Rational Valuations

The investment climate is shifting away from periods of high valuation exuberance, where market participation sometimes outweighed fundamental analysis. The “growth at any cost” narrative is losing traction. VCs now focus on sustainable unit economics, capital efficiency, founder experience, and corporate governance.

A startup must demonstrate a viable path to profitability and the ability to use capital efficiently, and founders should be prepared for rigorous due diligence, valuations closely tied to performance, and realistic projections.

VCs are showing appreciation for entrepreneurs with prior experience. Second or third‑time founders, or individuals with deep domain expertise from corporate careers, bring valuable maturity, established networks, a nuanced understanding of market dynamics, and proven abilities in navigating startup challenges. This experience can de‑risk investments and accelerate company growth.

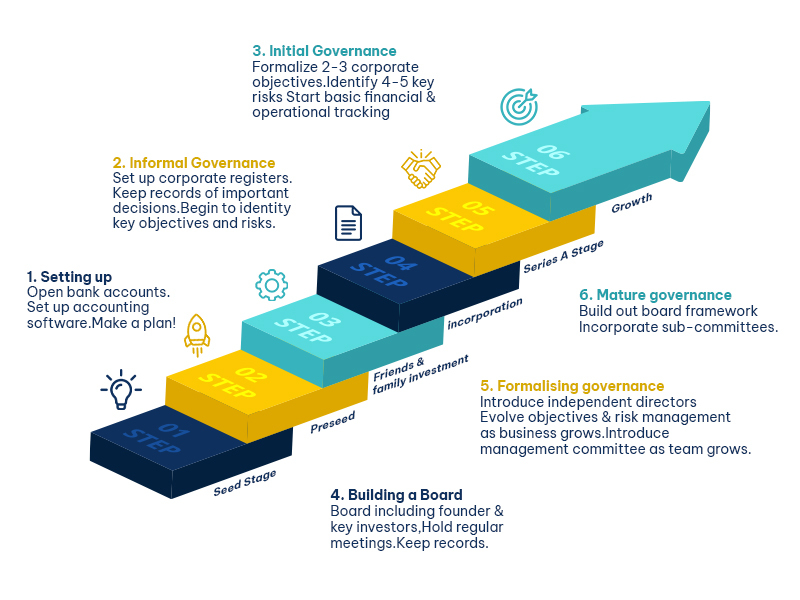

Following some highly publicized governance issues, VCs and their limited partners (LPs) are underscoring the importance of strong governance structures from a startup’s inception: thorough due diligence on founding teams, establishing independent and diverse boards, transparent financial reporting, and robust internal controls.

Effective governance is transitioning from a late‑stage compliance activity to a foundational element of a trustworthy and sustainable business. Founders are expected to embrace transparency and accountability as hallmarks of a well‑managed enterprise.

Corporate Venture Capital is Evolving, the Domestic Capital Pool is Deepening, and Micro-VCs are Playing a Strategic Role

As large Indian conglomerates leverage their corporate venture capital (CVC) arms to gain insights into disruptive technologies, explore new markets, identify innovative solutions, and scout for potential acquisitions, CVC is evolving from a primarily financial investment tool to a more strategic one. This shift provides startups access to “synergistic money” – capital combined with benefits such as market access through corporate channels, industry expertise, co‑development opportunities, and enhanced credibility. Founders should consider CVCs not just as funding sources but as potential strategic partners that can significantly accelerate growth.

The participation of domestic capital is increasing and strengthening the VC ecosystem. Indian family offices, high-net-worth individuals, and corporations are demonstrating a more sophisticated understanding of venture capital as an asset class, including its risk‑reward profile and its role in national economic development. They are consequently increasing their allocations to private equity and venture capital. This growth in domestic capital is vital for the long‑term sustainability of the ecosystem, reducing dependence on global market sentiments and fostering a more diverse and locally anchored funding base for VCs.

Micro VC funds (often sub‑$50M) focusing on pre‑seed and seed stages are playing a crucial role. Frequently managed by former founders or operators, these firms provide essential early capital and mentorship, backing unconventional ideas that larger funds might overlook. Instrumental in nurturing early‑stage innovation and expanding access to initial capital, they strengthen the pipeline for later‑stage investors.

India is now a Global Hub for Software‑as‑a‑Service (SaaS) and Fintech Innovation

Supported by cost efficiencies, a large pool of skilled engineering talent, and founders with global ambitions, Indian SaaS companies develop globally competitive, cost‑effective, robust, and innovative products. Market opportunities extend to Western countries, Southeast Asia, Africa, and the Middle East.

Global VC firms have expanded operations in India, domestic firms are investing too, and SaaS‑focused funds have been launched. While more capital is available, founders also face heightened competition, and they must differentiate through sustained innovation and excellent customer service.

As countries look to the India Stack, a suite of digital public infrastructures, Indian startups are building solutions leveraging these platforms, and UPI‑based fintech firms are exploring global markets. VCs are likely to support startups participating in “India Stack diplomacy, allowing India to extend its technological impact globally.

The Indian Creator Economy is Maturing and it is Ready for Sustainable Monetization

As the creator economy evolves from focusing on audience engagement towards more sustainable monetization models for creators, the Indian influencer marketing industry is expected to grow to Rs 4,500 crore in 2025. Startups are expected to develop tools enabling creators to manage exclusive content, build paid communities, sell merchandise, offer online courses, and manage their finances. Venture capitalists will likely seek startups that promote genuine creator entrepreneurship and develop scalable revenue models beyond inflated metrics.

Navigating the Future

Adaptability will be crucial for founders navigating the Indian VC landscape, as will be an emphasis on business fundamentals – clear unit economics, capital efficiency, and a focus on identifying and solving customer problems. Understanding target audiences, whether in India or globally, will remain a key differentiator. While periods of rapid, less scrutinized capital deployment may be receding, an era favouring thoughtful, impactful, and sustainable venture building is emerging.

VCs, in turn, are likely to adopt greater specialization and deeper domain expertise, fostering more collaborative partnerships with founders that extend beyond financial investment. They will focus on cultivating robust, diverse, and profitable ventures that address real‑world problems and create lasting value. For founders who align with these evolving dynamics, the Indian startup ecosystem offers a compelling platform for growth and innovation.