In 2016, calling yourself a founder in India still came with raised eyebrows. At family dinners, the safer question wasn’t “What are you building?” but “When are you settling down?” Unicorns felt mythical, early-stage capital was scarce, and consumer brands were expected to grow slowly, city by city, distributor by distributor, shelf by shelf. Entrepreneurship was admired from a distance, but rarely encouraged up close. India had talent and ambition, but lacked belief systems, institutional backing, and cultural permission to fail fast and try again.

Then on 16th January 2016, Startup India was launched with an audacious ambition: to create 100 unicorns, enable 10,000 startups, and fundamentally change how India thought about entrepreneurship. Many called it hyperbole – a vision disconnected from ground reality.

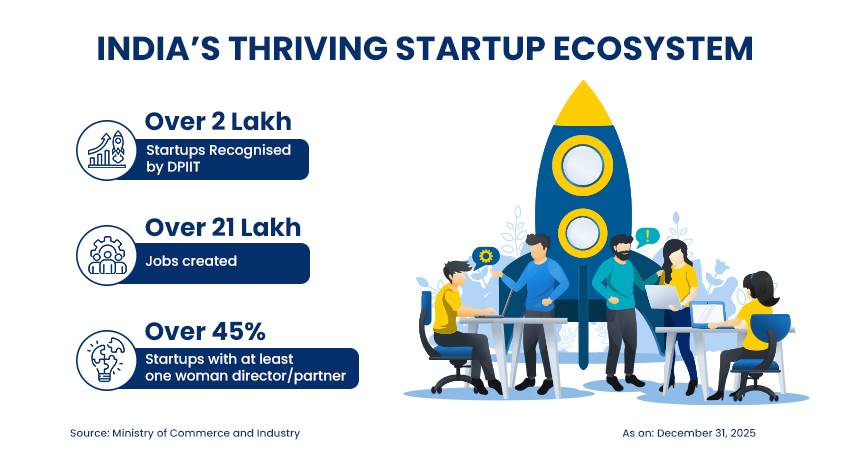

A decade later, those numbers look like modest milestones from a distant rearview mirror. Today, in 2026, with over 2,00,000 recognised startups and a sprawling network of nearly 125 unicorns, India hasn’t just joined the global entrepreneurial table; it is setting the menu. Startups today operate not just in metros but also in Jaipur, Indore, Kochi, Surat, and Coimbatore, rewriting where innovation can come from.

“I see startups, technology, and innovation as exciting and effective instruments for India’s transformation,” Prime Minister Narendra Modi said at the dawn of this movement. In hindsight, that transformation was never linear. It arrived in bursts, policy unlocks, infrastructure breakthroughs, consumer behaviour shifts, and moments of global validation that permanently altered India’s entrepreneurial trajectory.

Before the Shift: India’s Startup Landscape Pre-2016

Before 2016, entrepreneurship in India lived inside narrow corridors. Global capital viewed us primarily as a “back-office” economy rather than a product-first innovation hub. Consumer brands scaled through physical distributors and shelf space, not data and direct relationships. Digital adoption was uneven, and the “Angel Tax” loomed like a ghost over every transaction, penalising founders for the very capital they needed to survive.

What followed Startup India was not just policy support, it was a psychological unlock. The ecosystem moved from survival to ambition. Founders stopped asking “Can this be built in India?” and started asking “How big can this become from India?”

A decade later, the real story of Startup India is best understood not as a straight line of growth, but through ten inflection points that quietly and sometimes dramatically reshaped how Indian founders built and how Indian consumers behaved.

2016: Startup India and the Legitimacy Moment

The Startup India Action Plan was the “Big Bang” moment. It wasn’t just about tax breaks; it was about legitimacy. For the first time, “Founder” became a recognised profession in Indian society. DPIIT recognition, faster IP processing, self-certification under labour laws, and the ₹10,000 crore Fund of Funds collectively told founders that building companies was no longer a fringe pursuit; it was a national mission.

This mattered deeply for consumer startups. Brands like Licious and FreshToHome began organising deeply fragmented food categories using technology-led sourcing and cold-chain logistics. At the same time, companies like Udaan were reimagining B2B commerce, while Cure.fit started integrating fitness, food, and mental health into a single consumer ecosystem, ideas that previously felt “too ambitious” for India. The idea that even everyday Indian consumption could be reimagined at scale finally felt plausible.

2017: Capital Finds Early Believers

By 2017, the ecosystem saw the rise of organised angel networks. Capital began moving beyond Mumbai boardrooms and Bengaluru coffee rooms into Tier 2 founder ecosystems.

When Ratan Tata publicly backed startups like Urban Company and Ola, it sent a powerful cultural signal: the “New Age” had arrived. Consumer brands such as boAt began scaling by understanding millennial aspirations rather than competing purely on price. This period also saw early bets on brands like Wow Skin Science and Paper Boat, proving that storytelling, brand love, and community could be as powerful as discounts.

2018: The Flipkart Moment and Global Validation

The $16 billion Walmart–Flipkart acquisition was India’s global coming-of-age moment. Overnight, Indian startups were reclassified from emerging-market experiments to world-class assets.

The deal created the now-famous Flipkart Mafia, with former leaders going on to build and fund companies like PhonePe, Groww, and multiple commerce and SaaS ventures. Global investors recalibrated their risk assessment of India, and ambition across the ecosystem visibly expanded. It also validated India’s ability to build category-defining companies at scale, encouraging founders in logistics (Delhivery), travel-tech (OYO), and payments to think globally from day one.

2019: UPI and the Digitisation of Trust

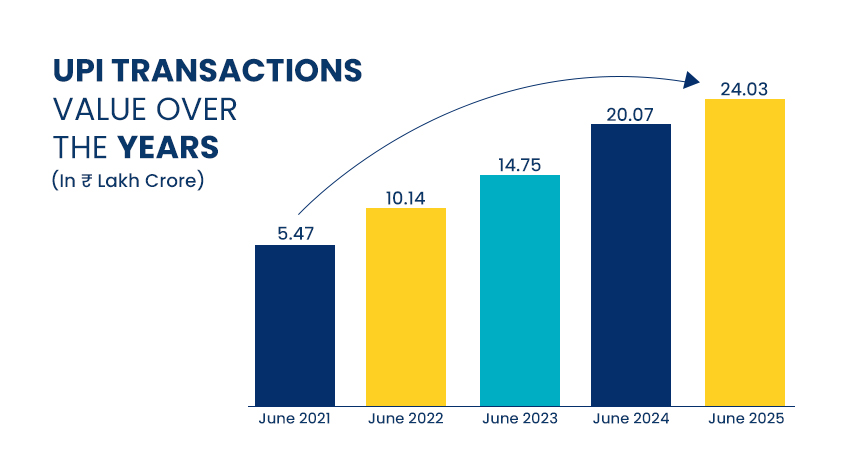

If there was one invisible force that rewired Indian consumption, it was UPI. By 2019, digital payments were no longer urban novelties but national habits. From kirana stores to D2C checkouts, transaction friction collapsed.

Brands like Nykaa, Mamaearth, and boAt converted impulse into instant transactions. India didn’t just digitise money, it digitised trust. Fintech startups such as PhonePe, Google Pay, and Paytm became default utilities, while small merchants were onboarded into formal digital ecosystems at unprecedented speed. Today, UPI processes 18+ billion transactions every month and handles over ₹24.03 lakh crore in payments, a scale unmatched globally.

2020: COVID-19 and the Great Digital Movement

Then came Coronavirus disease (COVID-19)!

The pandemic was a human tragedy, but for the digital economy, it served as a time machine, pushing 2025’s adoption back to 2020.

In the silence of the lockdown, the spirit of “Aapda Me Awsar” (finding opportunity in adversity) took flight. Zepto and Blinkit reimagined convenience, edtech platforms scaled at record speed, and healthtech became essential rather than optional.

The Indian consumer stopped asking “Why buy online?” and started asking “How fast can it get here?” Digital behaviour crossed the point of no return. Telemedicine platforms like Practo and PharmEasy, alongside diagnostics players, became frontline access points for healthcare, permanently changing trust in digital health services.

2021: India Becomes a Unicorn Factory

2021 felt unreal. India minted 44 unicorns in a single year, backed by record global liquidity. Startups across fintech, SaaS, and consumer brands scaled at unprecedented speed.

Nykaa’s IPO stood out as a cultural milestone. A profitable, founder-led, woman-led, D2C-first company going public shattered long-held myths about scale and sustainability. This visibility unlocked confidence for a new wave of women founders across beauty, wellness, and consumer services, leading to the 76,000+ women-led startups we see today.

2022: The Funding Winter and the Maturity Reset

As global capital tightened, India felt the chill.

Valuations corrected, burn-heavy models were questioned, and governance moved to the forefront. But this winter brought clarity.

Consumer brands like Mamaearth doubled down on profitability, offline expansion, and portfolio discipline. Growth slowed, but foundations strengthened. Founders began prioritising unit economics, supply chain control, and sustainable CACs over vanity metrics, marking a shift from blitzscaling to business-building and proving that the Indian ecosystem had the stamina for a marathon, not just a sprint.

2023: Beyond Apps, Toward Infrastructure

By 2023, ambition shifted from convenience to capability. Skyroot Aerospace’s successful launch symbolised India’s deep-tech confidence. Healthtech, EV infrastructure, and SaaS platforms began scaling globally.

Even consumer brands invested heavily in backend moats, manufacturing, supply chains, and data, marking a shift from front-end growth to long-term defensibility. This era also saw renewed focus on semiconductors, indigenous manufacturing, and AI-led platforms, supported by policy-level incentives and global partnerships.

2024: Sustainability Moves to the Mainstream

Sustainability stopped being a narrative and became a necessity. Climate-conscious consumers pushed EVs, circular fashion, and sustainable packaging into the mainstream.

ESG capital followed, and green innovation became commercially viable, not just ethically desirable. Brands and startups across EVs, clean energy, and sustainable materials began attracting mainstream consumers, not just niche adopters. With all this, the Indian household began voting with its wallet for a greener future.

2025–26: Startups as Economic Infrastructure

As we step into 2026, startups are no longer a sector; they are economic infrastructure. Their contribution has also increased in India’s GDP growth, employment, and exports under the vision of Viksit Bharat 2047.

With ₹10,000 crore committed through the Fund of Funds, which has already catalyzed over ₹55,000 crore in total investments and a ₹3,000 crore Credit Guarantee corpus, and an active IPO pipeline, Indian startups are entering their era of profitable scale and global expansion making the conversation shifted from “Can startups survive?” to “How can they anchor India’s long-term economic competitiveness?”

The Indian Consumer Story

Perhaps the most visible impact of this decade is on the Indian household. From brand-starved to brand-spoiled, consumers today have started choosing relevance over legacy. Data-driven brands like Wakefit and The Derma Co. replaced incumbents by understanding behaviour, not just demographics.

The Indian D2C market, once negligible, is now a $100 billion opportunity, with omnichannel no longer a strategy but the default. Consumers seamlessly move between Instagram discovery, UPI checkout, and offline experience, forcing brands to think ecosystem-first, not channel-first. In short, the “Reverse Migration” is in full swing, where digital-first brands are now opening physical stores, blurring the lines between the “kirana” and the “app.”

The Decade in Numbers

Between 2016 and 2026, India’s startup ecosystem has scaled across geography, gender, and sector:

| Metric | 2016 (The Launch) | 2026 (Today) |

| Recognized Startups | ~500 | 2,00,000+ |

| Total Unicorns | 4 | 125+ |

| Internet Users | 350 Million | 950 Million+ |

| Women-Led Startups | ~1,000 | 75,000+ |

| Jobs Created | ~50,000 | 21 Lakh+ |

(Source: PIB & Ministry of Commerce & Industry

Looking Ahead: The Skyscraper Era

The first decade of Startup India was about building foundations—policy, infrastructure, confidence. The next will be about skyscrapers: global Indian brands, deep-tech leadership, sustainable scale, and consolidation through IPOs and M&A.

As Ratan Tata once said, “Take the stones people throw at you and use them to build a monument.” Over the last ten years, India’s founders have done exactly that. They filled the gaps in infrastructure and regulatory hurdles and built a trillion-dollar monument to innovation.

The Indian dream didn’t just go digital. It became durable!